Predictions for Major Australian Cities in 2030

According to ABS data, the average residential dwelling price increased by $25,200 to reach $912,700 in the June quarter.

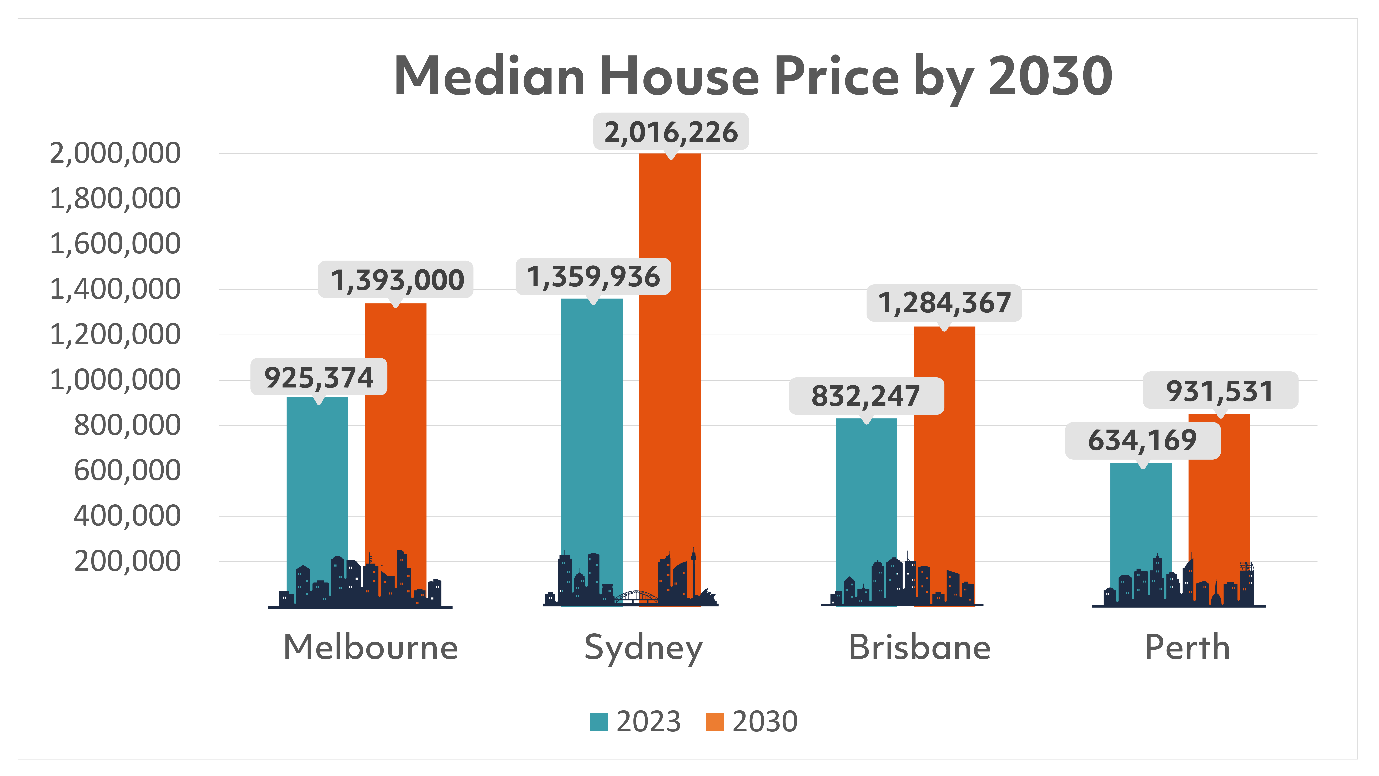

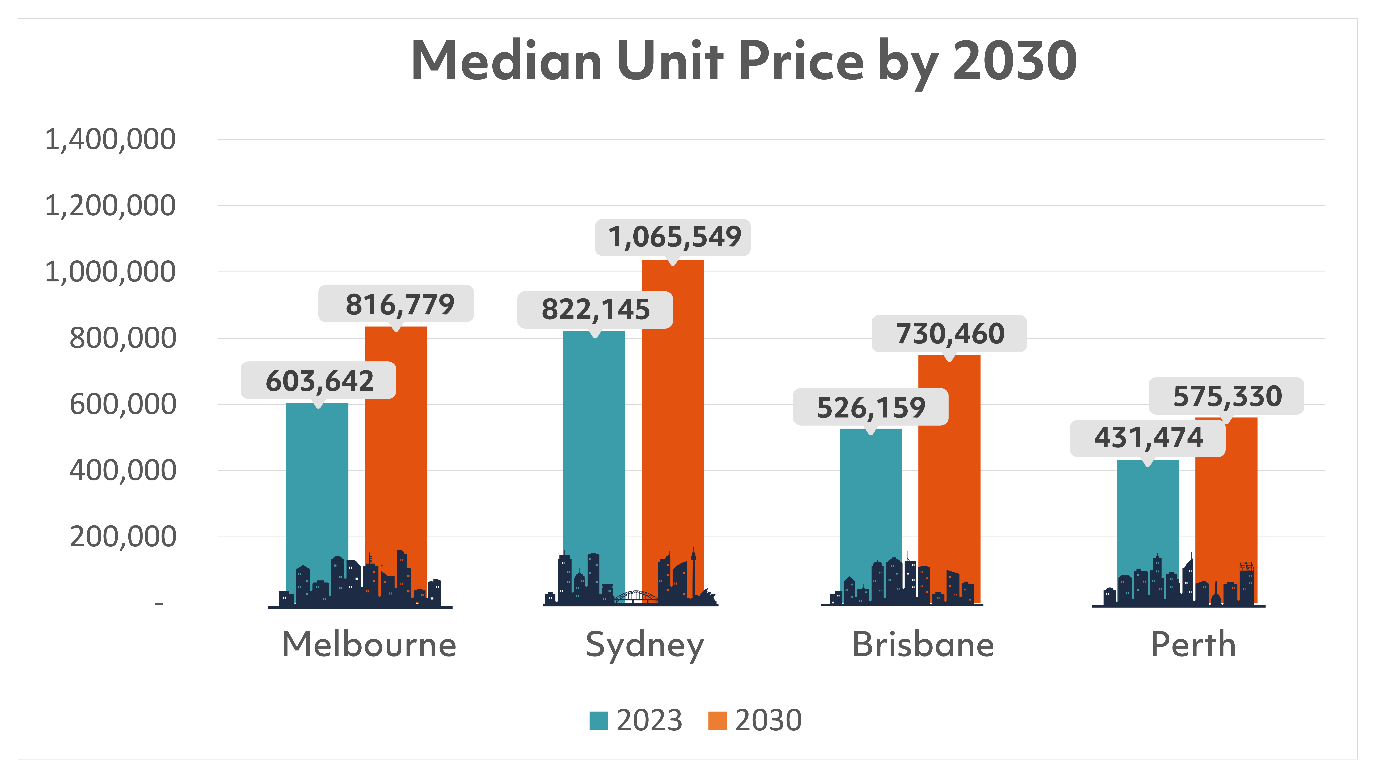

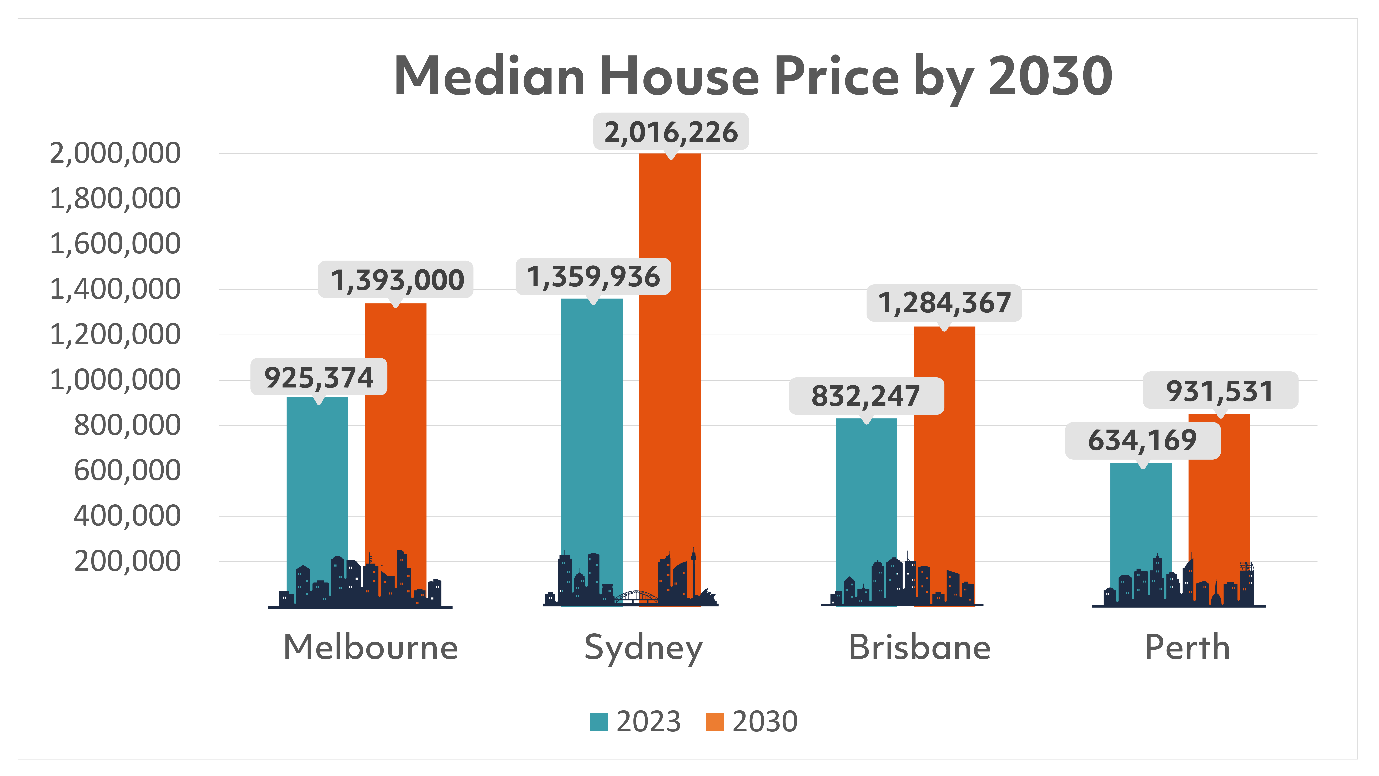

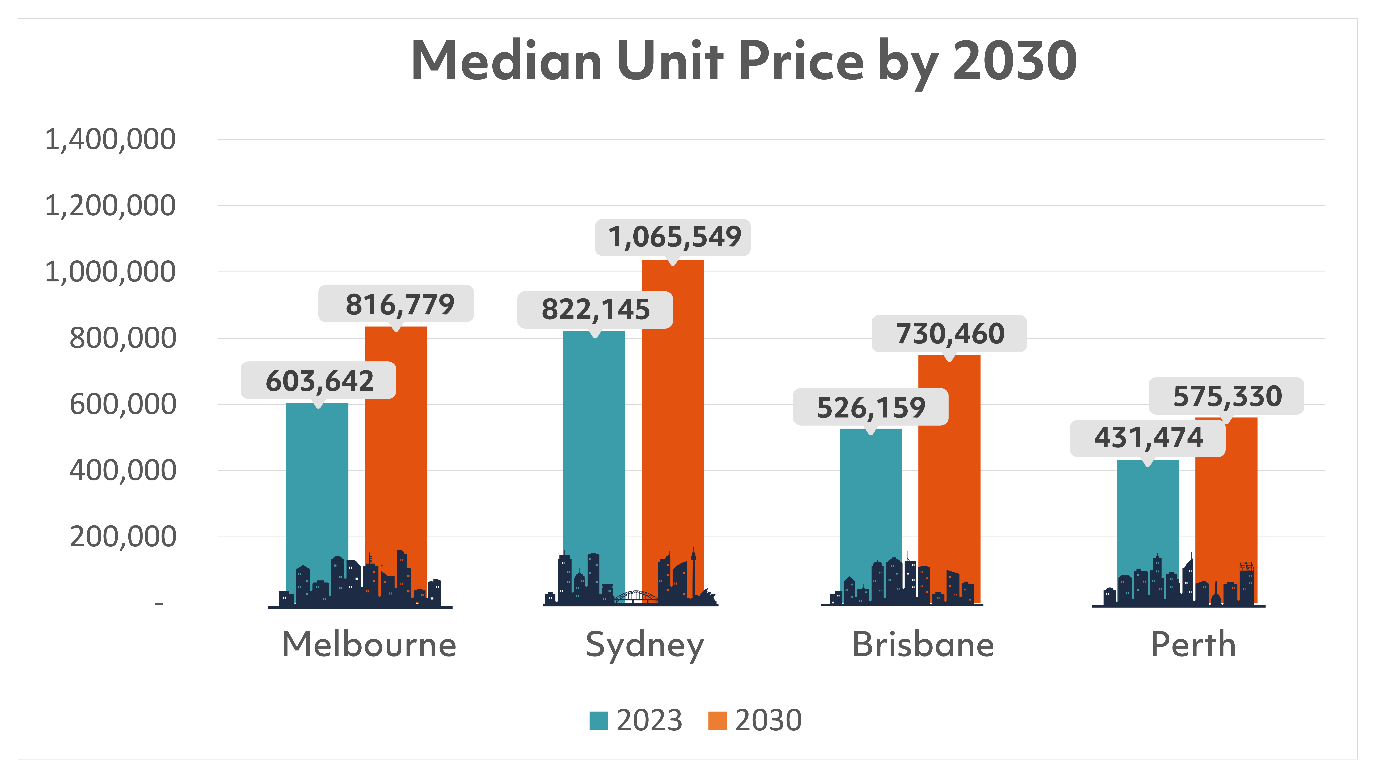

See below a comparison of the CoreLogic September 2023 median property price compared to the projected increases by 2030.

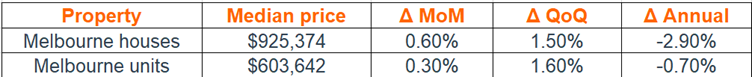

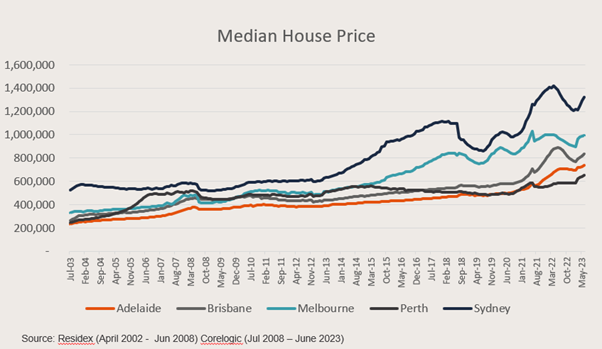

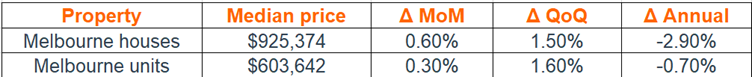

When it comes to the Australian property markets, Melbourne has consistently stood out as one of the top performers. Over the past two decades, median house prices have exhibited an impressive average annual growth rate of 6.0%, while units have seen growth at 4.4%. According to the CoreLogic Hedonic Index September 2023, Melbourne’s median house price stands at $925,374, with units averaging $603,642.

Assuming that this historical growth trend persists, experts are inclined to predict that Melbourne’s house prices could potentially soar to as high as $1.39 million by the year 2030.

Source: CoreLogic, Sept 1, 2023

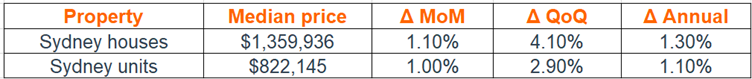

Sydney

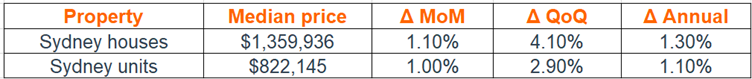

As per CoreLogic, the values of houses in Sydney have witnessed a remarkable growth over recent decades, reaching $1.36 million. Over the past two decades, houses have grown at an annual rate of 5.8%, and units at 3.8%.

Source: CoreLogic, Sept 1, 2023

For investors considering purchasing in Sydney, if this rate of growth were to continue at the same pace, Sydney house prices are expected to reach nearly $2.02 million by the end of the decade. This can be attributed to the city’s strong population growth, robust economy and major infrastructure projects, such as the $12.5 billion Sydney Metro City & Southwest project.

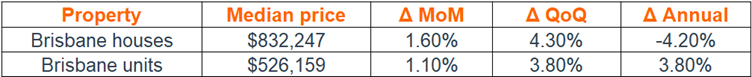

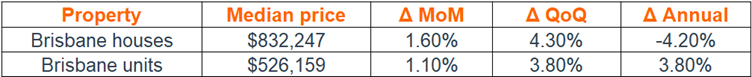

Brisbane

Investors should be pleased to note that CoreLogic data shows Brisbane house values have increased by 6.4% p.a. over the past 20 years, and units by 4.8%. Based on this trend, median house prices could rise to $1.284 million by 2030, and units to $730,000.

Brisbane’s strong population growth and substantial infrastructure spending is expected to underpin long-term property price growth. In the Queensland budget 2023-24 a record 4-year $89 billion capital program is rolling out, which will support around 58,000 jobs in 2023-24.

Source: CoreLogic, Sept 1, 2023

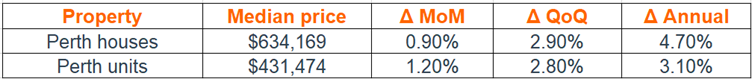

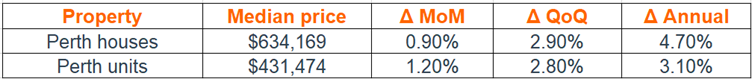

Perth

Perth has not missed out on the party either, with houses growing by 5.6% p.a. over the past 20 years, and units at 4.2%. If this growth continues, house values are set to hit $931,000 and units $575,000 by 2030.

With hundreds of millions of dollars of infrastructure spending planned, and the city’s population continuing to grow, the future is looking rosey for Perth property prices.

Source: CoreLogic, Sept 1, 2023