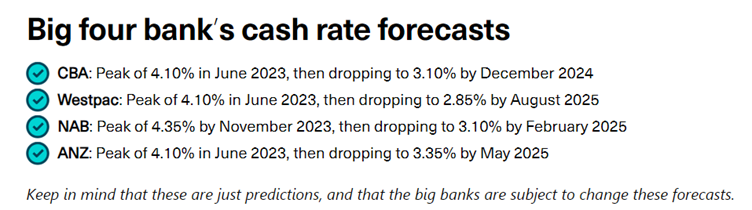

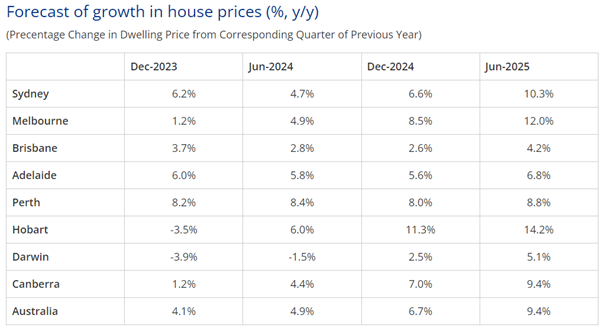

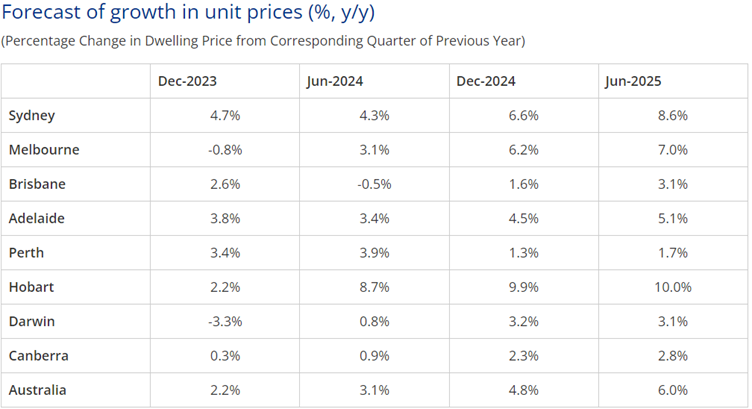

Get the latest big banks cash rate forecast and learn how property prices will surge in 2025

The Reserve Bank of Australia’s latest decision to keep interest rates on hold will have significant implications for Australia’s real estate market.

Interest rates always play an important factor in shaping the real estate market as they have an influence on the lending activity of consumers. Low-interest rates encourage more borrowing, which can lead to increased investment in property and higher demand for housing. High interest rates, on the other hand, can lead to less borrowing and consequently, less demand in the market.

The decision to keep interest rates at their current level will likely have a positive effect on Australia’s real estate market. For investors, low-interest rates can mean better returns on their investments. It also gives people the opportunity to leverage their investment by taking out a loan with more attractive repayment terms.