Perth, Brisbane and Adelaide housing affordability best in 20 years

Residential property in Perth, Brisbane and Adelaide hasn’t been this affordable since 1997, according to a peak industry body.

The latest Housing Industry Association (HIA) quarterly index reveals that housing affordability is at its highest level in 20 years in all of Australia’s capital cities, with the exception of Sydney and Melbourne.

“It is often overlooked that affordability conditions are favourable in the markets outside of Sydney and Melbourne,” said HIA senior economist Shane Garrett.

“Housing prices are more affordable in the other 6 capital cities today than has typically been the case over the past 20 years – primarily due to very low interest rates.”

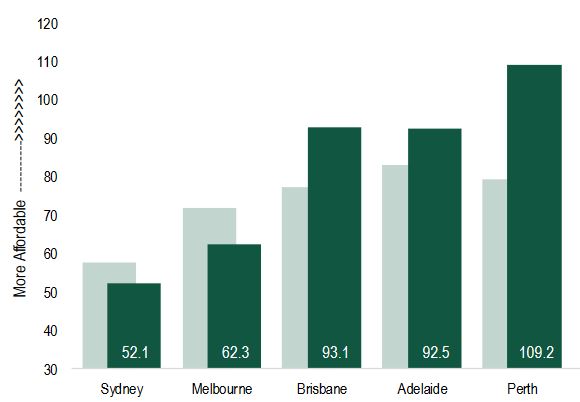

HIA Affordability Index for 5 largest capital cities, December Quarter

The HIA affordability index measures mortgage repayments as a proportion of typical earnings in each market.

Perth is now Australia’s most affordable capital city, with an average monthly mortgage repayment of $2,194 representing 27.5% of gross average earnings, the Urban Developer reports.

| City | Average monthly mortgage repayment | % of gross average earnings |

| Sydney | $4,559 | 67.5% |

| Melbourne | $3,566 | 48.2% |

| Adelaide | $2,160 | 32.4% |

| Brisbane | $2,466 | 32.2% |

| Perth | $2,194 | 27.5% |

“The HIA Housing Affordability Index saw a small improvement of 0.2% during the December 2017 quarter indicating that affordability challenges have eased,” Mr Garrett said.

During the December quarter, out of the 5 biggest cities, the largest improvement in affordability occurred in Sydney (+3.1%), followed by Brisbane (+1.4%) and Perth (+1.3%).

“Housing affordability is a hot topic at the moment, particularly for those living in Sydney and parts of Melbourne. This latest release from the HIA shows that in fact the majority of capital cities in Australia are very affordable,” said Ironfish National Apartments Manager, William Mitchell.

“Many Australians are now migrating interstate to the more affordable cities, and taking the opportunity to greatly reduce or eliminate their mortgage. Savvy investors are seeing this trend and getting into those markets whilst they are still affordable, as in time, this interstate migration movement will have an impact on prices.”

If you are interested in premium property investment opportunities in Perth, Brisbane or Adelaide, register to access our selected properties list.