APRA ends 7% serviceability requirement

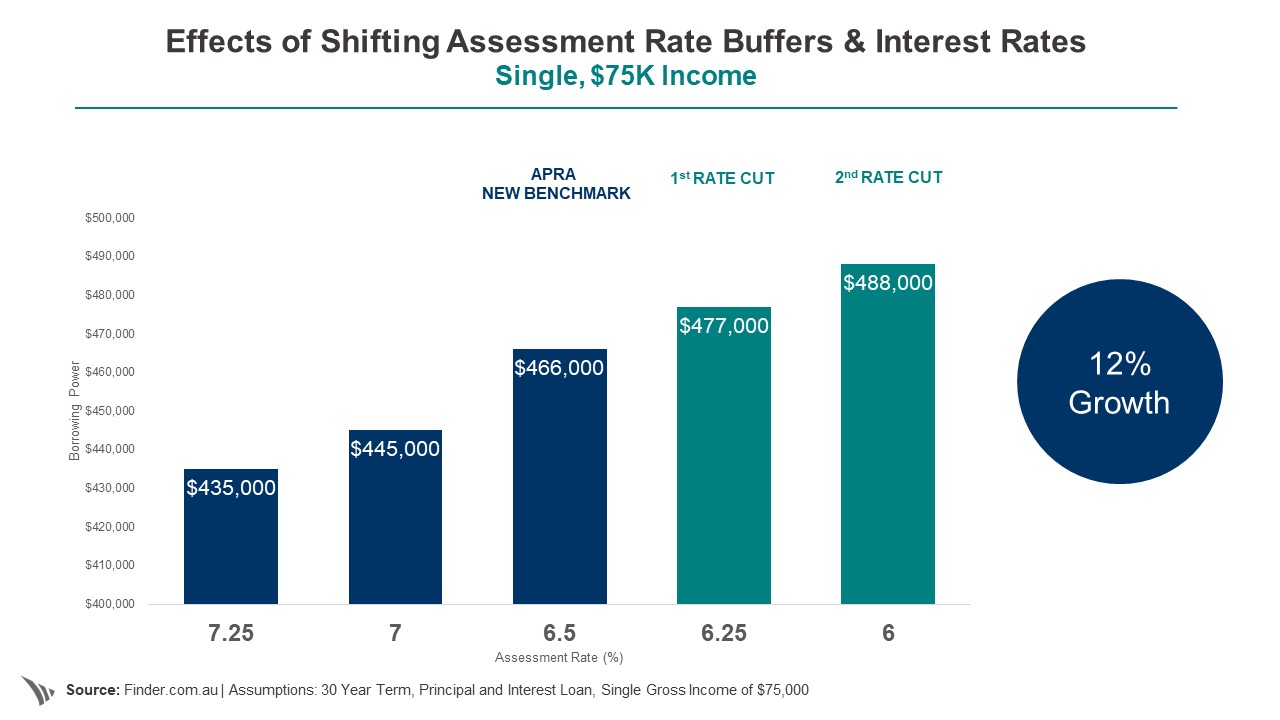

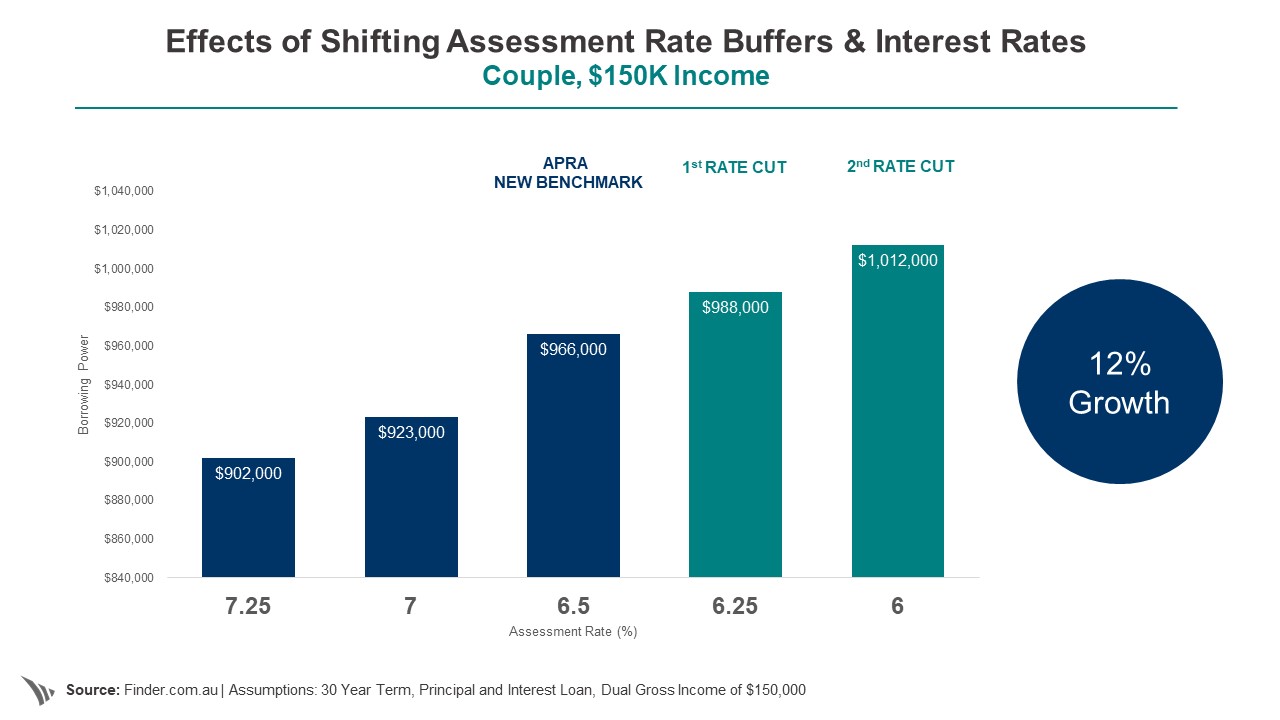

Getting a mortgage will get easier from today. In good news for property buyers, APRA has today confirmed it will end the serviceability buffer requiring lenders to assess whether their borrowers can afford their mortgage repayments using a minimum interest rate of 7%.

Effective immediately, banks will now merely add 2.5% on top of the loan’s actual interest rate to determine whether the borrower can service the loan.

APRA Charmain Wayne Byres said today that the 7% buffer was no longer necessary.

“A serviceability floor of more than seven per cent is higher than necessary for ADIs to maintain sound lending standards” Mr Byres said in a statement.

Until today, most banks assessed borrowers at 7.25% so this change will have a significant impact on many Australians looking to secure finance for a home or investment property.

The announcement comes just days after the RBA announced a second cash rate cut, down to a historic low of 1%.

It’s the first time since 2012 that the RBA has cut interest rates twice in consecutive months.

How much will the average home owner save?

| Old rate (May) | New rate (July) | Monthly savings | Annual savings | |

| CBA | 4.77% | 4.33% | $105 | $1,259 |

| Westpac | 4.58% | 4.18% | $94 | $1,133 |

| NAB | 4.51% | 4.07% | $103 | $1,239 |

| ANZ | 4.56% | 4.13% | $101 | $1,215 |

Source: Rate City, Based on an owner-occupier paying principal & interest repayments on a $400,000 loan on a discounted variable rate with one of the big four banks

“This is welcome news for anyone with a mortgage or looking to finance a new home or investment property,” said Ironfish Head of Property William Mitchell.

“APRA has recognised that there are many people who can afford a loan but were facing a barrier due to the high serviceability requirements. Now with borrowing capacity likely to increase, along with record low interest rates, we see that as positive news for the property markets.”

To stay up to date on the latest property news and updates, subscribe to our monthly newsletter.