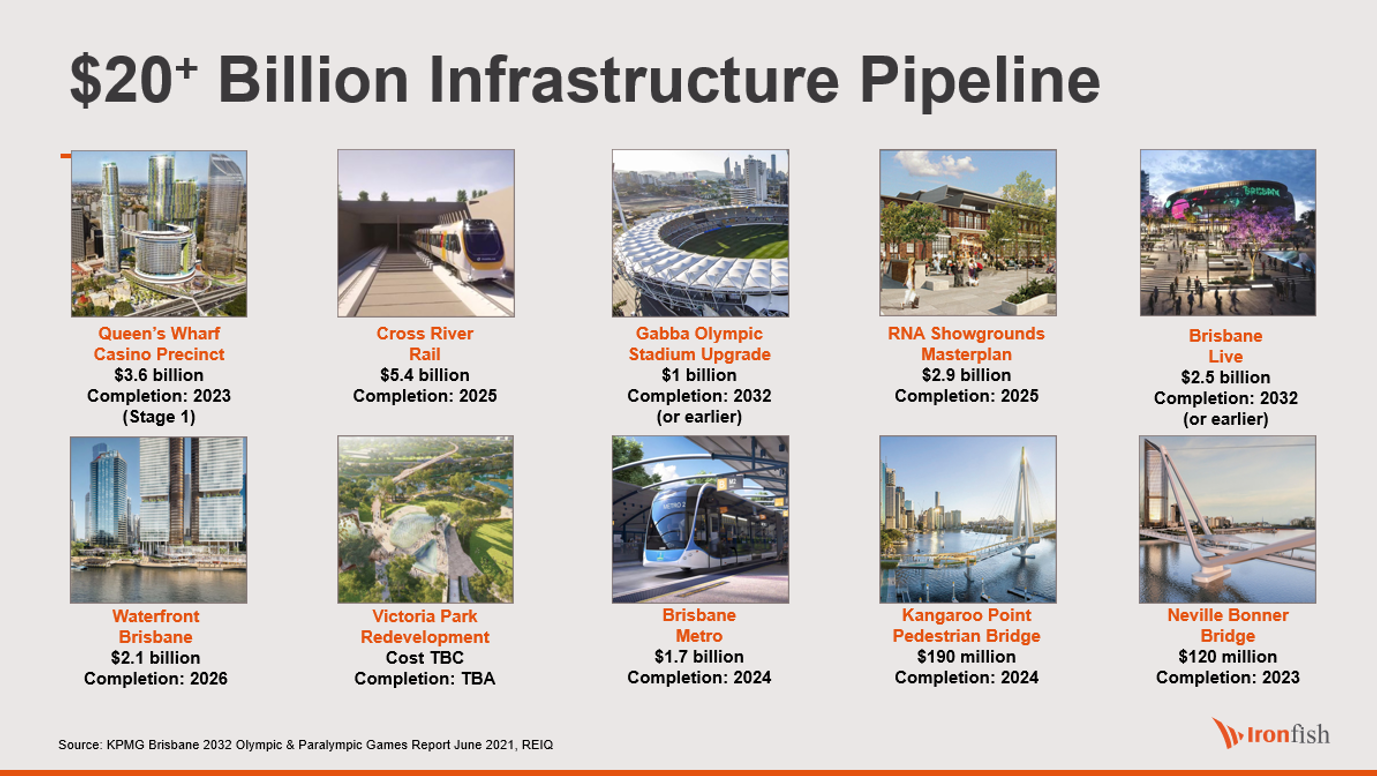

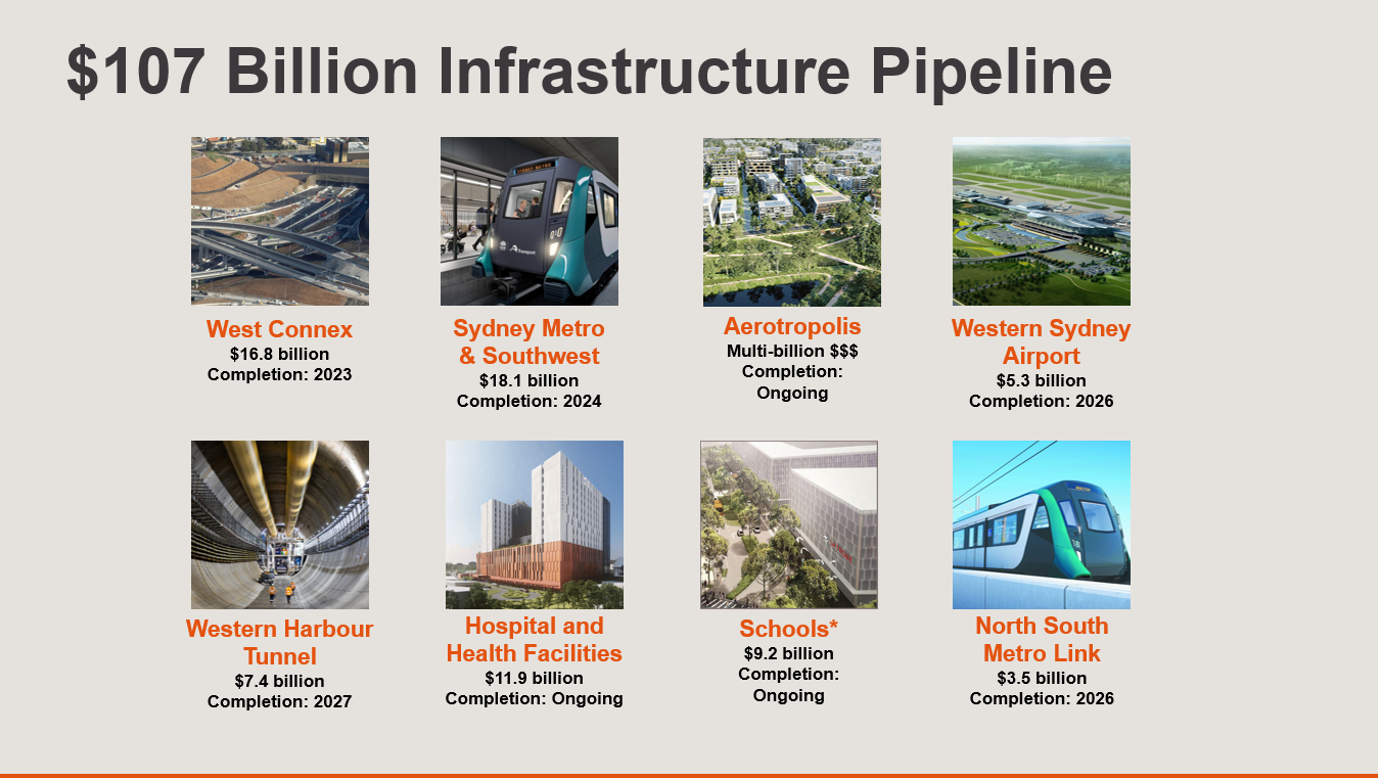

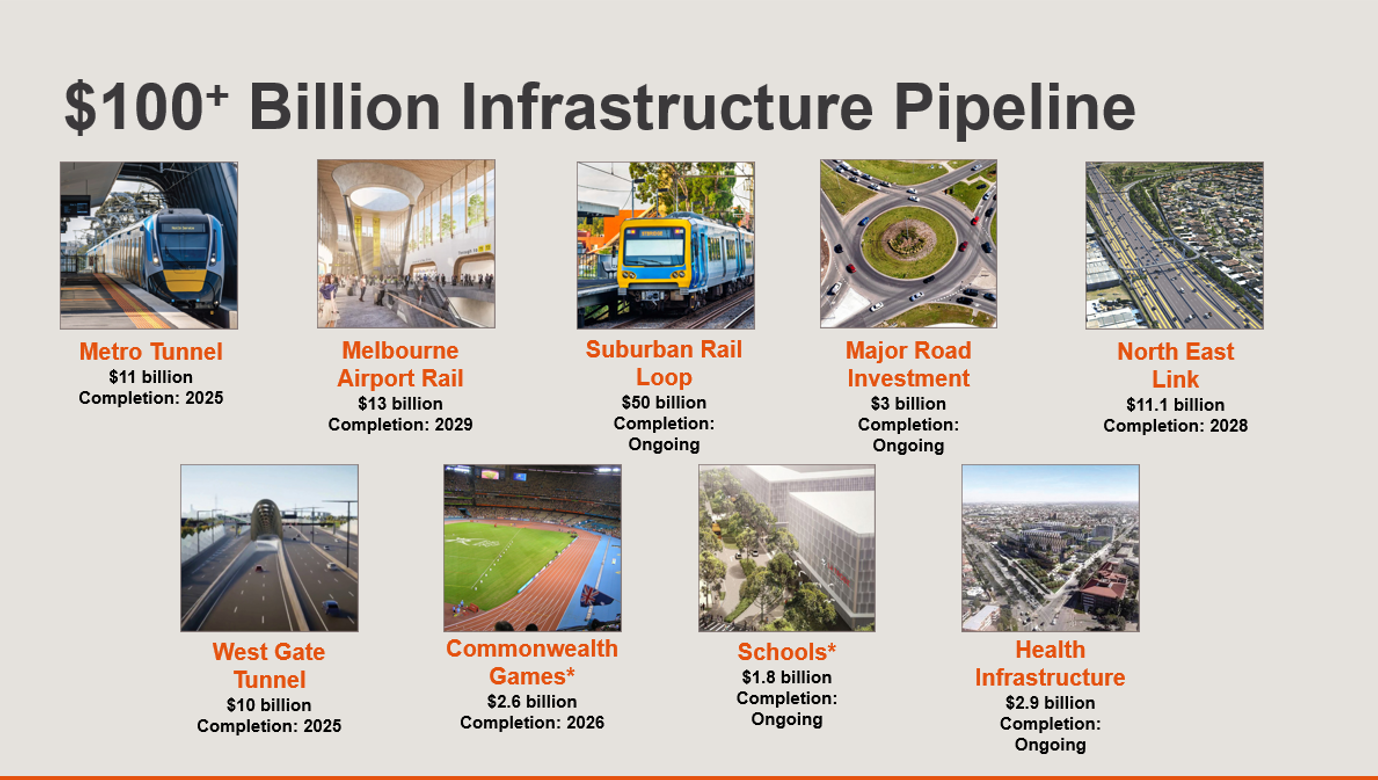

Australia’s massive infrastructure boom is putting property investors in prime position

With official population projections tipping a massive increase in the number of Australians over the next 30 years, the Federal government is investing heavily in new infrastructure across the country. Working on the premise that we will have over 30 million people in Australia by 2031, and more than 49 million by 2066, the 2023 federal budget will keep the $120 billion 10-year infrastructure pipeline rolling to ensure our infrastructure can cope with the population growth.