Brisbane Property Market 2025: Data Insights, Emerging Trends & Expert Forecasts

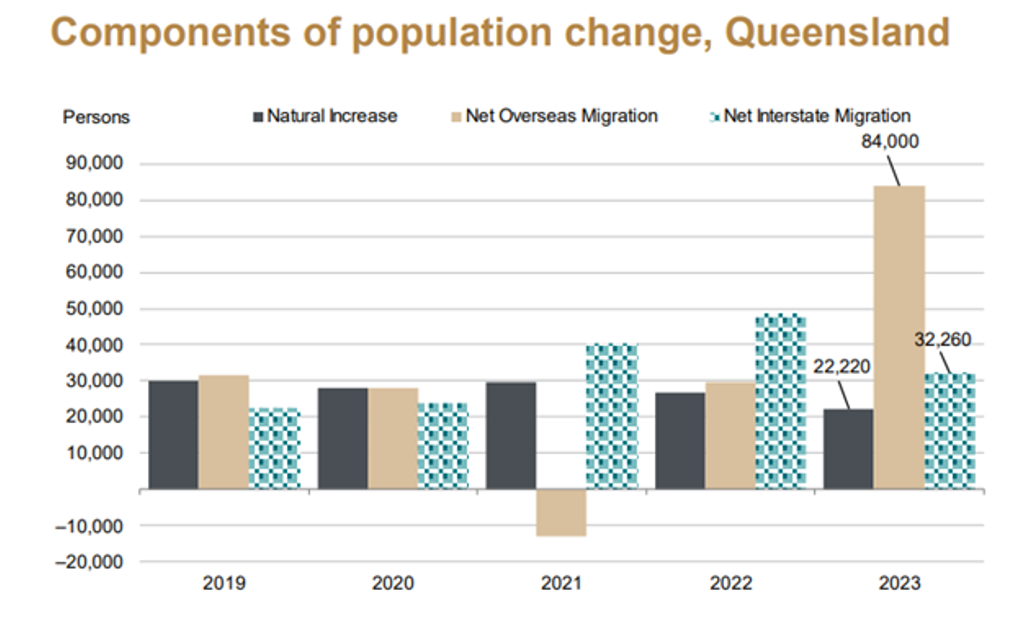

Brisbane’s growth story is compelling. Its booming population, driven by affordable living costs and lifestyle appeal, is matched by significant investments in infrastructure. New projects such as the Cross River Rail, Brisbane Metro, and airport expansions are setting the stage for unprecedented future growth.

Investors are flocking to the Sunshine State, drawn by Brisbane’s unbeatable combination of lifestyle appeal, major infrastructure projects, and record-breaking population growth.

2025 is shaping up as a critical time for investors to capitalise on the opportunities presented by Brisbane’s property market. In this article, we’ll explore data insights, emerging trends, and expert forecasts to provide a comprehensive overview of what the future holds for Brisbane’s property market.