Challenges Ahead: Australia’s Growing Housing Gap by 2027

Is the great Australian Dream of owning your home in peril? Australia is facing a housing gap as 2027 rapidly approaches.

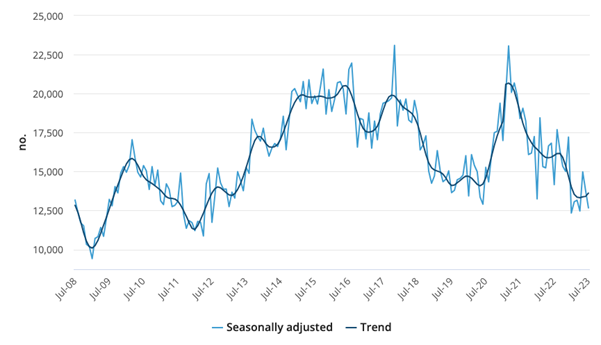

According to the Australian Bureau of Statistics, Australia could be facing a shortfall of 175,000 homes in the next five years. A remarkable 11% growth in the cost of new homes has been driven by an acute shortage of available homes in the market, leading to a surge in housing prices nationwide.

For investors, there exists an opportunity to fill the housing gap through affordable housing solutions such as the build-to-rent model. Armed with the right investment strategies, now is a great time to enter this market and provide much-needed solutions for the growing housing space.