Federal Budget 2018 – what property investors need to know

Strong economic projections, tax cuts and strategic spending are key focus points in Treasurer, Scott Morrison’s third Federal Budget.

But for investors, the Budget centrepiece is no doubt the announcement of a further $24.5 billion to be spent on major transport infrastructure projects across the country as part of the Government’s $75bn 10-year infrastructure blitz.

“The tax cuts for low and middle-income earners in the year’s Budget have garnered much attention and media coverage – however, for us and for investors, the big news is the commitment to major infrastructure projects across all the 5 major capital cities, with Melbourne and Brisbane enjoying the lion’s share of the $25billion spend.

“With rapid population growth, and the fast pace of urban development across our major cities, it’s exciting to see some major funding commitments to developing these large-scale transport projects, which will deliver significant benefit to the surrounding areas,” said Ironfish National Apartments Manager, William Mitchell.

Economic surplus

The economic projections released by the Treasurer on Tuesday night would see the budget return to surplus ahead of schedule by 2021 ($11bn in 2020-21 and $16.6bn in 2021-22).

The early return to surplus comes off the back of stronger than expected economic growth, which will now be a healthy 3% over the next 4 years. The treasurer also noted that jobs growth has been substantial, with 415,000 jobs created last year alone, three quarters of which were full time.

The improved economic conditions have allowed the treasurer to pay for some major national infrastructure projects from recurrent spending – instead of borrowing, for the first time since the GFC.

$24.5 billion infrastructure spend

With Australia’s fast-growing population, and increasing demands placed on existing infrastructure, the Government has committed to a number of key projects including:

- Melbourne Tullamarine Airport Rail Link

- Western Sydney Airport rail

- Brisbane Metro

- Perth Metronet

- M1 upgrade on the Gold Coast

- Brisbane Bruce Highway upgrade

- Adelaide North-South Road Corridor

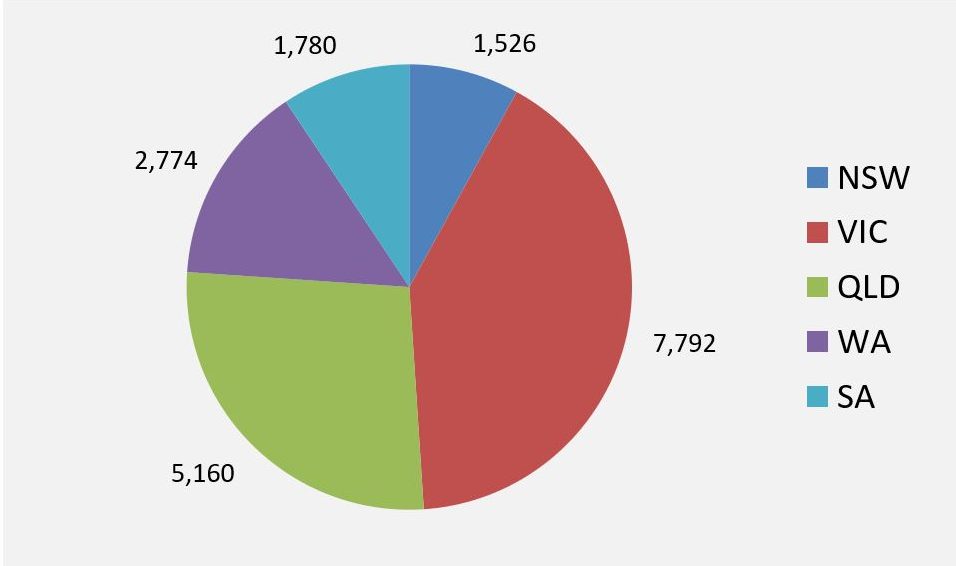

All states are set to benefit from new infrastructure, though Victoria and Queensland are the big winners in terms of spending allocation. In fact, Victoria will receive the biggest federal infrastructure spend in the state for decades ($7.8bn) – perhaps unsurprising given Melbourne’s booming population which is set to overtake Sydney by the 2030s.

The Government has also committed a $1 billion Urban Congestion Fund, to tackle congestion, and spur infrastructure in new projects to help commuters.

The Budget also promises to start construction this year on the $9 billion inland rail project from Melbourne to Brisbane.

Federal Budget 2018/19 infrastructure spending by state

Key infrastructure projects announced

According to the Budget papers, for every dollar the Federal Government invests on infrastructure, a return of $4 will be delivered to the economy.

Housing affordability

After last year’s budget, which included many property-related measures, there was notably little in the 2018 Budget for housing affordability or First Home Buyers. The two major initiatives to note include:

- confirmation to continue to unlock a supply of affordable housing and establish the $1 billion National Housing Finance and Investment Corporation

- $1.6 bn to support state affordable housing services, down roughly $295 million from last year’s Budget.

Property investment

From July 1 2019, property owners will no longer be able to claim a tax deduction for expenses associated with owning vacant land, “to address concerns that deductions are being improperly claimed for expenses, such as interest costs, related to holding vacant land, where the land is not genuinely held for the purpose of earning assessable income”.

The change will apply to land held for residential or commercial purposes although the “carrying on a business” test would generally exclude land held for commercial development.

This measure will not apply to expenses associated with holding land that are incurred after a property has been constructed on the land, it has received approval to be occupied and is available for rent, or if the landowner is using the land to carry on a business, including primary production.

No changes were announced in the Budget to capital gains tax or negative gearing.

Reverse-mortgage for retirees

The last Federal Budget offered incentives for retirees to downsize their homes. This year, the Budget focused on a new plan to allow every homeowner over the age of 65 to unlock equity in their own home (up to $11,799 per year) for the rest of their lives.

This scheme was initially only available to part pensioners, however, now anyone over the retirement age can access equity in their homes without selling them, at a maximum rate of 150% of the age pension.

The 2018 Federal Budget offers important insights for investors. The overall outlook is positive, with the economy performing well and strong jobs growth. Supported by a significant infrastructure spend program, the capital cities are set to see continued economic activity and jobs growth, both of which underpin long term property demand and value.

If you would like further information about the 2018 Federal Budget and how it may affect your property investment plans or the local property markets in 2018-2019, feel free to book a complimentary appointment with one of our experienced Strategists.

You can also download our latest quarterly market report.