Why is housing supply not meeting demand?

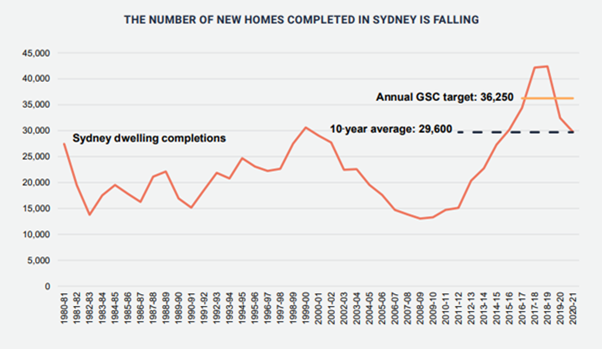

One significant factor contributing to the undersupply of housing in Sydney is the influx of migration. Sydney, being a global city, attracts a large number of migrants each year, which increases the demand for housing. Secondly, the pace of new developments has been slow, affected by planning and zoning restrictions. These regulations often delay the approval process for new developments causing a lag in the supply of new housing.

In addition, the construction industry, which plays a pivotal role in housing supply, has been facing challenges such as rising costs of raw materials and labour shortages. These factors have slowed down the construction and completion of housing projects.

Government policies and initiatives

The NSW Labor Government is taking steps to tackle the housing crisis in the state by prioritising the construction of additional social and affordable homes through the NSW Land and Housing Corporation (LAHC) and the Aboriginal Housing Office (AHO). This includes an expanded State Significant Development (SSD) approval pathway for projects consisting of 75 or more homes, or with a capital investment exceeding $30 million.

Government aid and policies play a crucial role in addressing the housing supply gap. Various government schemes, such as the First Home Buyers Assistance Scheme (FHBAS), are designed to support new buyers entering the market. Under the FHBAS, first home buyers in NSW get a transfer duty exemption or reduced rate when purchasing an existing or new home, or vacant land (up to $1 million value).

These incentives not only aid individual home buyers but also stimulate the overall housing market by increasing demand and ultimately encouraging capital growth. Aspiring property investors should view government first home buyer schemes as a means of getting started on their property journey so as to gradually build a successful investment portfolio over time.

What next?

One potential solution to the critical undersupply of housing in Sydney is increasing collaboration between private developers and community housing providers, as seen in initiatives such as the Build-to-Rent scheme which aims to increase the supply of affordable rental properties. The ‘build to rent’ model aims to increase the supply of rental housing by improving investment options for property investors. Not only does this model result in the delivery of high-quality rental properties that are well-managed and cater to the needs of tenants, but it also presents opportunities for investors to diversify their portfolios and contribute to solving the housing crisis in Sydney.

The critical undersupply of housing in Sydney is an urgent issue that demands immediate action. Whether it is through government initiatives to support first home buyers or innovative collaborations between private developers and community housing providers, it is evident that a multi-faceted approach is necessary.

Addressing the housing supply issue should be the top priority for Sydney in 2024. Without a sufficient increase in affordable, quality homes, the city risks exacerbating social inequities and limiting the potential for economic growth. Property investors have an important role to play in this issue, and by supporting initiatives such as the ‘build to rent’ scheme, they can contribute to working towards a solution. Investing in properties that are close to public transportation, employment opportunities, and essential amenities will not only lift the burden on Sydney’s housing market but also help investors reap the benefits of long-term, sustainable rental income.