NSW Post-Election Wrap Up: What does a new Labor Government mean for property investors?

On Saturday the 25th of March, New South Wales voters went to the polls and voted in a new Labor Government, ending 12 years of Coalition rule.

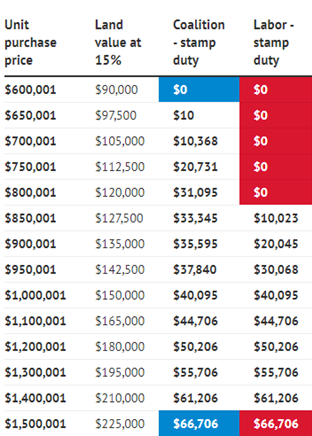

During the campaign, both sides of the political divide made it a priority to address key issues impacting property investors, such as housing affordability and rental reforms. In a major election pledge, NSW Labor revealed its plan to abolish or dramatically reduce stamp duty for eligible first-home buyers. No stamp duty at all will be applied to homes up to $800,000, significantly increasing the existing exemption of $650,000. Labor will also offer stamp duty concessions for first-home buyers who purchase properties worth up to $1 million. As the new NSW Government takes shape, property investors will be watching closely to see how these pledges into play.

With promised big changes to both stamp duty and land tax on the horizon, it’s important to know how the recent Labor win will impact your property portfolio. In this article, we’ll look at the two key issues impacting property investors as a result of the election, and uncover how to maximise your property investments with the new Labor Government.

But first, let’s set the scene.