Perth at the centre of global lithium boom

When you think of Australia’s vast mining or resources sector, iron ore, coal or perhaps even uranium typically come to mind.

However, in the space of only a couple of decades, Australia – or effectively Western Australia – has quietly become the world’s largest producer of a different mineral, and one which is experiencing a massive surge in global demand: lithium.

Lithium – growing global demand

Lithium batteries made worldwide headlines when Elon Musk famously made a pledge on Twitter to deliver the world’s largest lithium battery at an Adelaide wind farm in ‘100 days or it’s free’.

But the growing demand for lithium spans beyond renewable battery and energy storage – it’s also the driving force behind a fast-growing industry: electric vehicles.

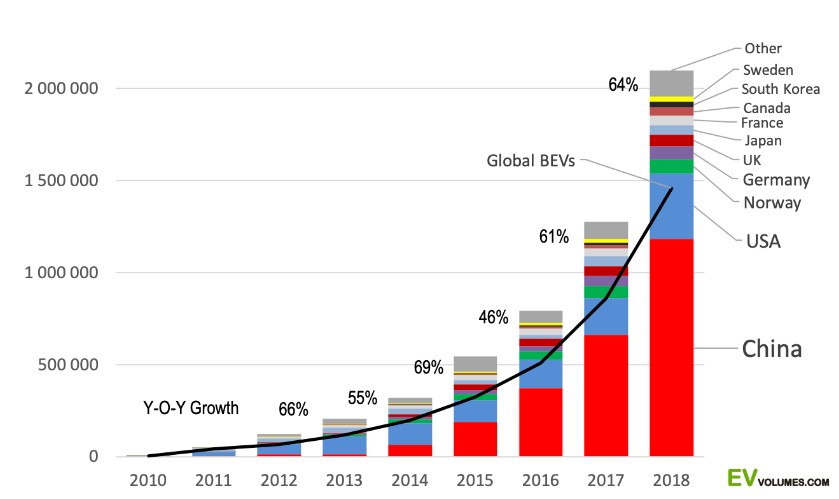

The global popularity of electric cars is soaring, with global manufacturers, especially in China, producing new electric vehicles at an exponential rate.

As global demand for electric cars reaches new heights, so too does demand for lithium, which is a key ingredient of electric car batteries. The surge in demand has driven up the price of lithium four-fold in just four years.

The exponential growth of electric vehicles

Electric Vehicle Production | Source: EV Volumes

Australia: largest global market share of lithium

In 2000, Australia’s market share of raw lithium production was 13%. By 2018, Australia owned more than half of the world’s total market share of lithium output.

The number of jobs in the sector has risen almost seven-fold in just three years, according to the Western Australia Government.

Chief Economist at the Department of Industry, Innovation and Science, Mark Cully, estimates lithium to be worth hundreds of billions of dollars for Perth and the wider Australian economy.

“Australia has strong potential to move to the centre of the global lithium supply chain given its geological advantages, its experience in rolling out mining investment, and the skills of its workforce,” Mr Cully said.

Australia’s lithium boom

Lithium Jobs Growth, Market Share Trend, and Price Growth | Source: WA Government and Australian Financial Review

Lithium mines are spread out across the country in South Australia, Queensland and Northern Territory, though Western Australia (WA) holds the most significant deposits. WA has announced several new mines in the last 12 months alone. To provide a sense of the scale of these projects, the five largest of these WA mines have a project value of $2.8 billion.

“Australia is now the lithium capital of the world and Pilgangoora is one of the biggest lithium mines on the planet,” said Neil Biddle, Co-founder of Pilbara Minerals, which opened its mine and processing plant in February 2019.

“We [Australia] are already global leaders in gold and iron ore and we can do the same with lithium.”

Iron-ore price surge

While the lithium industry charges full steam ahead, global demand for iron ore has also spiked.

A recent suspension of major iron ore mines in Brazil has driven iron ore prices up significantly higher than Government predictions only a year ago.

The 2018 Federal Budget originally forecast the price of iron ore at $US55 a tonne; however, it is now hovering at $US86, representing a 56% premium to last year’s forecast.

The global iron ore price spike is expected to add an additional $6 billion to this year’s Federal Budget, to be released early next month.

Iron Ore Price Trend | Source: MarketIndex.com.au

As the global demand for electric cars and new-generation batteries continues to surge, the impact on the Perth economy is expected to be impressive. Further supported by a strengthening resources sector, the Perth economy over the medium term will be a hot topic amongst keen investors.

Property investment in Perth

Keen to learn more about the fundamental drivers of the Perth property market? Download our latest quarterly market report or watch our latest video market update below.