Queensland has long been renowned for its strong economic performance, but the latest CommSec State of the States Report confirms Queensland is truly leading the charge over Eastern state rivals New South Wales and Victoria.

For the first time in the report’s 13-year history, Queensland has ranked as the best-performing state for economic activity. This is due in large part to its healthy population growth, job creation, and mining activity, which have all been supported by strong infrastructure spending by the Queensland government.

In the battle of state economies, Queensland has been gaining a strong head of steam over the past few years and is primed to see even more success now that the upcoming Olympics are on its horizon.

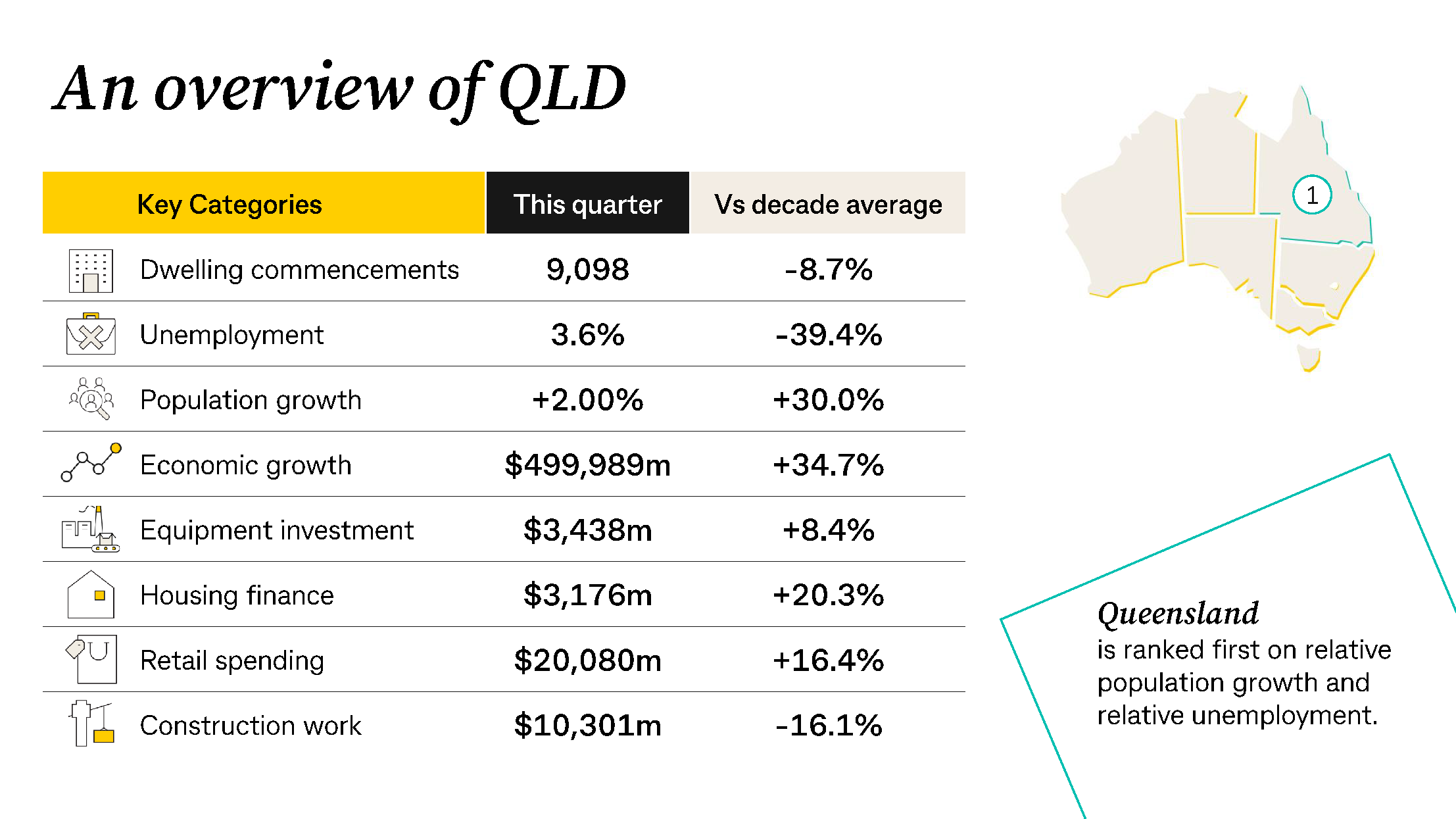

By analysing 8 key indicators such as gross domestic product, retail spending, and construction activity over a period of time, this comprehensive analysis provides valuable insights for property investors looking to gain a better understanding of the potential risks and rewards for investing in each state.

Start Your Journey

Take the first step towards better results. Book your expert consultation today!

What makes Queensland such an attractive option for property investors?

Queensland is the best performing economy for the first time with migration a key driver.

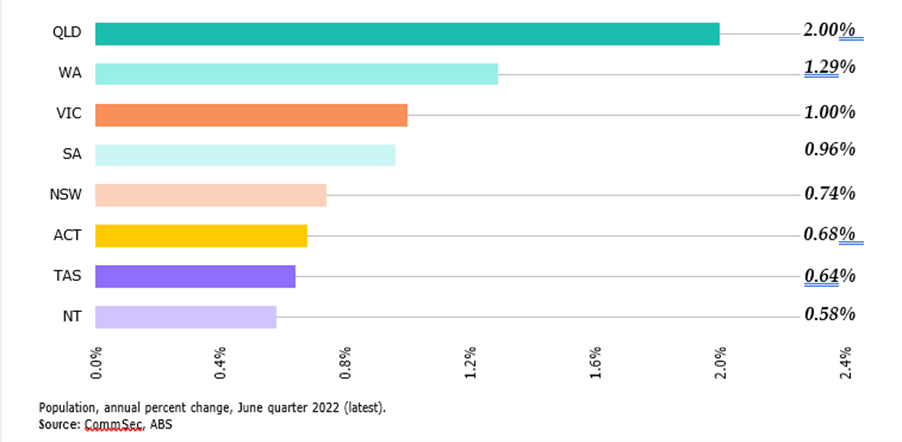

The Sunshine State has become the second-largest economy in Australia and is growing at a faster pace than ever before. At the same time, Queensland is ranked first when it comes to population growth – a key driver of its economic success – thanks to high net migration rates.

Despite traditionally taking a backseat in the economic rankings, Queensland’s diversification of its economy means it is now well-supported by solid mining, energy, and tourism sectors. The evidence of this momentum is clearly evident within its first-rank status on relative population growth and relative unemployment, as well as second-rank status on three out of eight economic indicators. With these indicators pointing to a bright future, Queensland property investors can have confidence in the potential for strong returns on their investments.

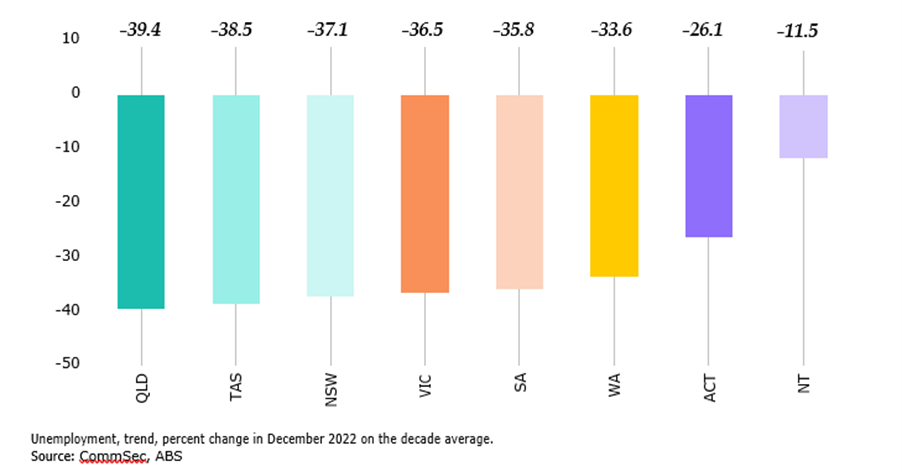

With unemployment at 39.4 per cent below its decade-average level, Queensland has the strongest job market.

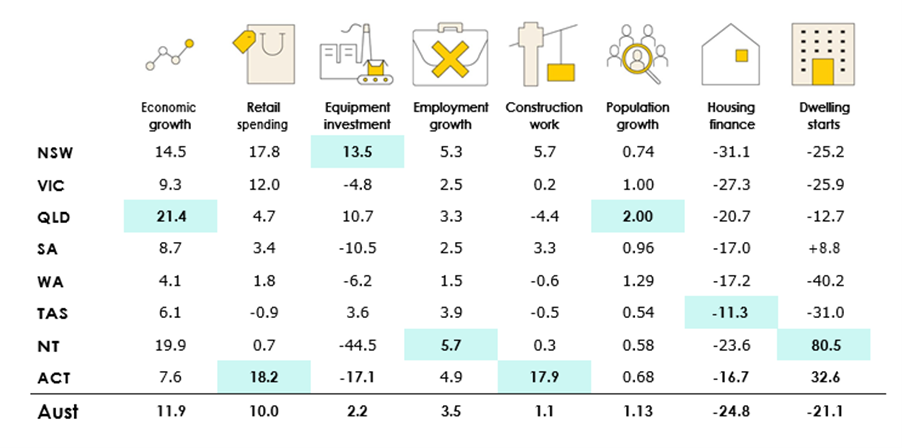

How are other Australian states and territories faring?

Queensland, the Northern Territory and the ACT lead annual changes on the key economic indicators.

Economic growth continues to be strong throughout the other states and territories, with Gross State Product (GSP) keeping pace as a steady measurement of progress. Particularly in WA, we’re seeing remarkable relative economic growth which is 36.6% above the normal decade average. This, combined with data regarding jobs, commodities, inflation, and interest rates, all points to a vibrant Australian economy that appears set for further prosperity in the coming months and years.

Here is how the State of the States report ranks the other states and territories:

- NSW – third place for investment in equipment and employment

- SA – led the nation in construction projects and dwelling commencements

- VIC – first on retail spending

- WA – first on relative economic growth

- TAS – first on equipment investment

- ACT – first on housing finance

- NT – third on relative economic growth.

What does Queensland's success mean for property investors looking to purchase in the Sunshine State?

The CommSec report paints a positive picture of Queensland’s current and future economic prospects. With Queensland’s property market set to benefit from increased jobs, population growth, and investment in infrastructure – as well as the buzz that comes with hosting the Olympics – savvy property investors should place South East Queensland firmly on their shortlist as a smart choice for investment.

“The 2032 Olympics will create 130,000 jobs, accelerate crucial infrastructure and attract billions of dollars of investment into the region. This will be a great foundation for growth in Queensland over the coming decade.” according to Grant Ryan, Director of Property & Research at Ironfish.

Queensland property investment, whether it’s Brisbane, the Sunshine Coast or Gold Coast, provides the perfect opportunity to reap the rewards of a strong and vibrant economy.

We expect to see strong capital growth in Queensland property prices due to the rising demand for housing stock from both domestic and international buyers. As such, investors can also expect to see rental yields remain steady, or increase slightly, due to the number of people looking for places to call home in Queensland.

Final thoughts

As always, due diligence is required when purchasing an investment property. Whether you’re purchasing a Queensland investment property or one in another state, it is important to have full visibility into the economic outlook of the respective area and to make sure that your investment aligns with your desired outcomes.

At Ironfish, we understand the nuances between investing in residential and investment-grade properties. We saw early on that renting to live (emotionally driven) versus buying an asset (rationally driven) requires different decision-making processes – which is why we use very strict criteria when deciding on what to share with our clients. We focus on location, considering the growing population in the area, infrastructure, and amenities, as well as close proximity to jobs and transport links–all vital factors in creating rental demand. Our property choices are further refined by choosing only the best developers and conducting quality checks on off-the-plan construction to ensure they meet Ironfish’s high standards of architectural design.

With Ironfish, you can be sure that your property investment is backed by more than just data, but by our expertise and experience too. Get in touch to launch your journey towards financial freedom today.

Start Your Journey

Take the first step towards better results. Book your expert consultation today!