Real Estate and Retirement: How Many Properties Are Enough For Retirement?

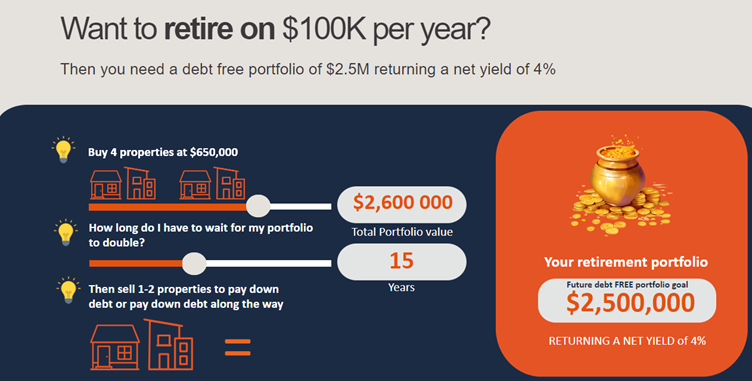

If your plan is to fund your retirement through real estate investments, you may be wondering how many properties are enough to achieve your retirement goals.

To generate a substantial passive income and achieve financial freedom often requires more than just one or two investment properties. Once you understand the power of a diversified portfolio, you will realise why 4 is a magic number when it comes to property.

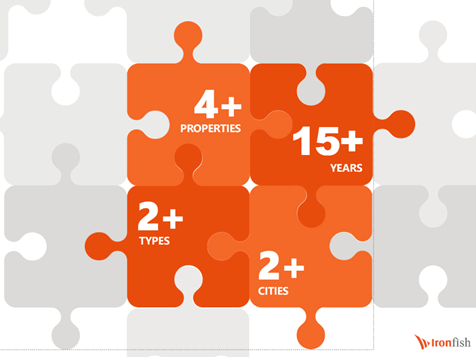

The ‘4 investment properties in 6 years’ strategy involves carefully building a diversified property portfolio, to build long-term wealth creation and stability. This is an effective approach for those seeking to attain true financial freedom to live your retirement years in ultimate comfort.

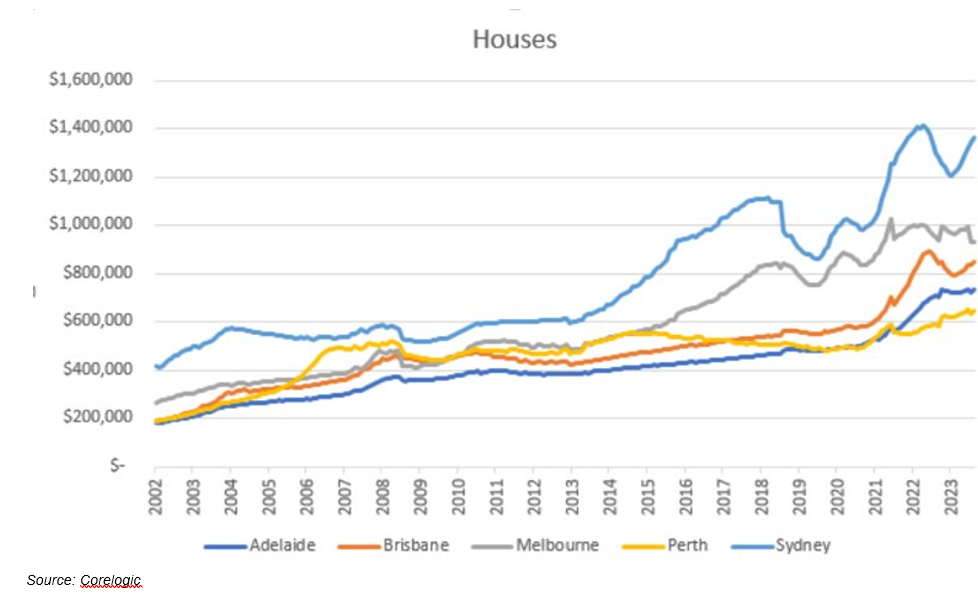

By diversifying your investments, you set yourself up for success by targeting assets with varying degrees of price points, locations and rental yield. A diversified portfolio that one that is invested across States borders, this is key for property investors as it allows returns to be optimised across the portfolio and minimises the risk of loss due to external factors. By building a well-rounded property investment portfolio, you optimise the potential for both steady cash flow and robust capital growth.