Those who choose this path are often referred to as ‘rent-vestors’, as they rent where they want to live, and invest where they can afford.

So what are the pros and cons of each options, and which path is right for you?

Start Your Journey

Take the first step towards better results. Book your expert consultation today!

Book a free 90-minute one-on-one session designed to assess where you’re at and help you identify a strategy to achieve your goals.

Buying your home first

Buying your first home is a tremendous achievement, synonymous with the great Australian dream. Living in your own home means you can customise or renovate the property according to your taste or needs. You can also live there as long as you like – without having to worry about a landlord kicking you out.

There are also many incentives in place, such as stamp duty reductions or subsidies from the government for first home buyers.

Thirdly, in Australia, your home is exempt from capital gains tax when you decide to sell it down the track. I.e. If it grows in value, you don’t have to pay tax on those gains.

On the other hand, many people who decide to buy a home first will have to compromise on location, size or type of property due to affordability / budget constraints.

Others may feel restricted by taking on a home loan – they may feel less free to be able to take opportunities to travel or change careers, start a business or work overseas.

Buying a home first also means missing out on potential tax benefits with keeping an investment property.

Buying an investment property first

If you buy an investment property first, the first benefit is that it can be treated purely as a commercial asset. I.e. You don’t need to be emotionally attached, it doesn’t need to be in your favourite suburb. All you need to focus on is cash flow and long-term potential – which widens your pool of choices considerably, as you could even look at different cities or interstate.

With an investment property, you can take advantage of any tax benefits available to you, such as depreciation and negative gearing. Because banks are willing to lend up to 80%+, with the power of leverage, a higher potential return on your cash investment is possible.

With rent-vesting, you also have greater freedom in terms of where you live, as you can rent your preferred home in a preferred location – which may be an area in which you couldn’t afford to buy.

Correspondingly though, buying an investment property first means missing out on first home owner grants, CGT exemption as well as the potential lack of stability in having your own home to live in.

What about cashflow?

While both options have their own advantages and disadvantages – what do the numbers look like from a purely cashflow perspective?

Let’s take a look at a very simple example:

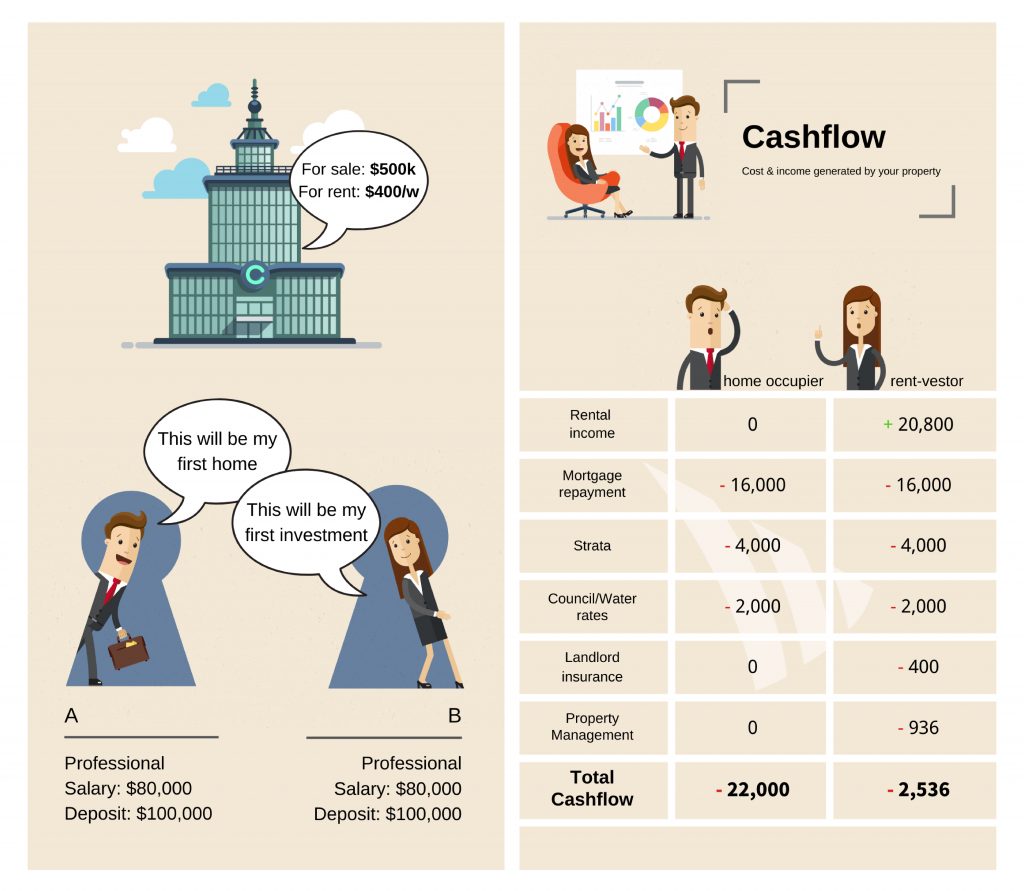

Assume there are two new apartments in the same apartment building. Both sell for $500,000 each, with a weekly rent of $400 each.

John and Jane both have an annual income of $80,000 and $100,000 in savings. Both borrow $400,000 from the bank to buy one of the apartments. Both take interest only loans, paying an interest rate of 4%. John is a first home buyer, while Jane buys to invest.

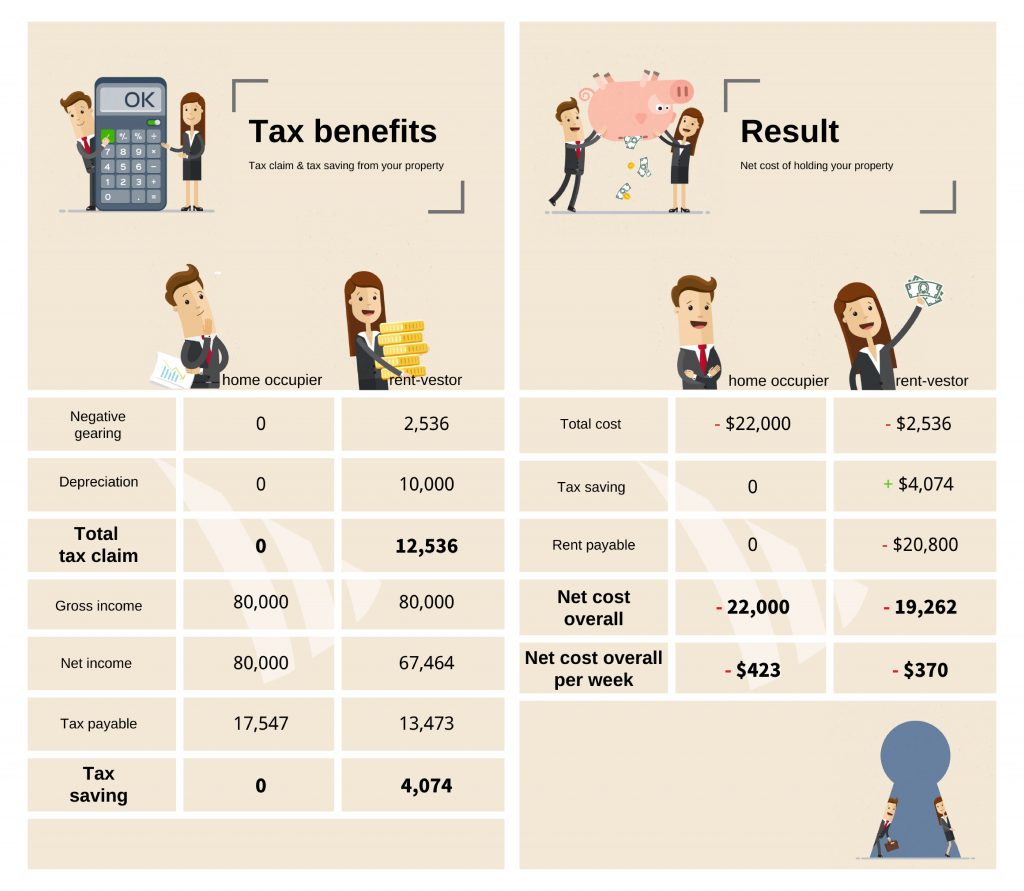

At the end of the year, First Home Buyer John, with no tax claims or rental income, will have paid -$22,000 for the year overall.

Rent-vestor Jane has a tax claim of $12,536 (out of which only $2,536 is an ‘out-of-pocket’ cost, while $10,000 is her depreciation deduction for the new property). As a result, she saves $4,074 in tax. If Jane rents the exact same property for $400 per week, Jane will have paid $19,262 for the year, or $370 per week. That’s a $53 per week saving compared to if she’d bought the property as her home or $2756 savings for the year.

While this is just a simplified example, it demonstrates the power of ‘thinking outside the box’ instead of following the conventional path to home ownership without stopping to consider other options.

Owning your own home feels great, but if your goal is to build wealth for the long-term, it may be worth talking to a professional before choosing which path to take.

Ironfish is a national property investment services platform, with offices in all the major cities in Australia. To learn more about investing, book in a free appointment with one of our strategists via the link below.

This article is intended to provide general information only, current at the time of first publication. It does not constitute any financial advice, offer, contract or inducement to buy. Investors are expressly recommended to do their own due diligence in relation to any investment decision they make and seek independent financial advice.

Start Your Journey

Take the first step towards better results. Book your expert consultation today!