As part of Ironfish’s philosophy of working hand-in-hand with our customers to educate towards a great long-term outcome, this article provides a simple explanation of positive and negative gearing as well as some example cashflow scenarios – including one often-overlooked tax benefit.

For buy-and-hold investors, cashflow is an essential consideration – being able to hold your property long-term to achieve the targeted capital growth.

Start Your Journey

Take the first step towards better results. Book your expert consultation today!

What is positive gearing and how does it work?

Simply put, a positively geared property is one where your incomings i.e. rental income are higher than your outgoings i.e. mortgage repayments, repairs, strata fees, council rates, resulting in positive cash flow before tax.

Advantages of Positive Gearing

Cash in Hand

Having a property fully covered by rental income means that you immediately begin generating positive cashflow.

Profit without relying on capital growth

Positive cashflow means immediate income from your investment, as opposed to relying on property prices to increase to make a profit.

Increased purchasing power

As a result of having a better cashflow, you can potentially use this to further build your investment portfolio or pay down an existing mortgage on your principal place of residence.

Points to Note

Taxable income

Income generated from a positively geared investment is counted as extra income and thus will be taxable.

Relatively rare

According to the ATO, only 40% of Australian property investors have a neutral or positively geared investment. Often to achieve positive gearing, creative strategies are sometimes required to make the property more desirable in the market.

These strategies sometimes involve actively renovating or adding value to existing property, or better yet, investing in properties with strong rental yields (i.e. 5.5%) whilst interest rates are low in the current environment. Often, positively geared property with strong rental yields are found in regional locations, however these types of investments experience lower capital growth – but in certain pockets of capital cities there are opportunities for stronger rental yielding investments, it is just a question of knowing where to look!

Positive Gearing over Time

Quality properties in prime locations can experience rental growth over time. This increase in rent over time has the potential to convert negative geared properties into positively geared properties.

What is negative gearing?

As you might guess, negative gearing is the opposite of positive gearing where rental income received from the property is less than the sum of outgoing costs. So why would an investor choose to seemingly lose money?

Advantages of Negative Gearing

Reduce taxable income

When a property is negatively geared, the shortfall can be claimed as a loss when doing your tax return. By reducing your taxable income you can reduce the amount of tax payable. Many investors choose to negatively gear their investment for this purpose, with the aim of achieving strong capital gains over time.

Focus on capital growth

Investors who choose negative gearing are typically targeting long term capital growth above their accumulated losses for when the property is sold. This means that in the short term, negatively geared investors are able to save on tax whilst benefiting from long-term capital growth.

Lower Interest Rates

Interest rates are currently at a historic low in Australia, making negative gearing a popular option for many investors as many properties are now only incurring a small loss, making it easier to hold onto an asset.

Points to note:

Maintain a buffer

A high income or cash reserve is often needed to maintain a negatively geared investment strategy to ensure you’re able to hold the property long enough to achieve the targeted capital growth.

Buying Power

Since a negatively geared property investment is not generating positive cashflow, this may make it harder to build on your existing portfolio.

Growth location/quality property

It’s always important to choose a great location and a quality property with strong long-term potential – more so with a negatively geared property where you are targeting long term price growth.

Paper vs out-of-pocket costs - understanding tax depreciation

The conversation around gearing tends to go hand in hand with tax or tax benefits – as a tax saving or tax increase can impact your cashflow over the year.

Owners of investment properties are eligible to claim tax deductions for a number of expenses involved in holding a property. Most investors are aware of some of the deductions they are entitled to claim such as their property manager’s fees, council rates and any repairs and maintenance costs.

However, often investors are unaware of property depreciation, which for new properties, in particular, can have a big impact on cashflow – and whether a property has positive or negative cashflow.

What is depreciation?

Over time, any building and the assets contained within it will experience wear and tear. Legislation allows investors to claim this wear and tear as a tax deduction called depreciation.

But unlike other expenses involved in holding a property, such as repairs and maintenance for instance, an investor does not need to spend any money to be eligible to claim it.

For this reason, depreciation is often described as a ‘non-cash deduction’. I.e. it’s not an out-of-pocket cost, but you can still claim it as a deduction.

Many investors choose to purchase new properties to take advantage of the higher depreciation claimable compared to older (second-hand) properties with low or no depreciation to claim.

What equipment qualifies for depreciation?

Common items that qualify for depreciation includes:

- The building’s structure

- Dishwasher & washing machines

- Carpet & timber flooring

- Exhaust & ceiling fans

- Microwaves & ovens

- Smoke alarms & air conditioning

- Cooktop & furniture

How to obtain a depreciation report?

A depreciation report is provided by a Quantity Surveyor – this report will outline all the deductions an investor can claim for any specific property at the end of each financial year. Your accountant will then use the figures outlined in the depreciation schedule when submitting the investor’s individual income tax return at the end of financial year.

Negative gearing - with positive cashflow?

A common misconception with many investors is the idea that a negatively geared investment property always means negative cashflow. But the following, simple example, illustrates that this isn’t always the case – as depreciation can have a significant impact on cashflow for new properties.

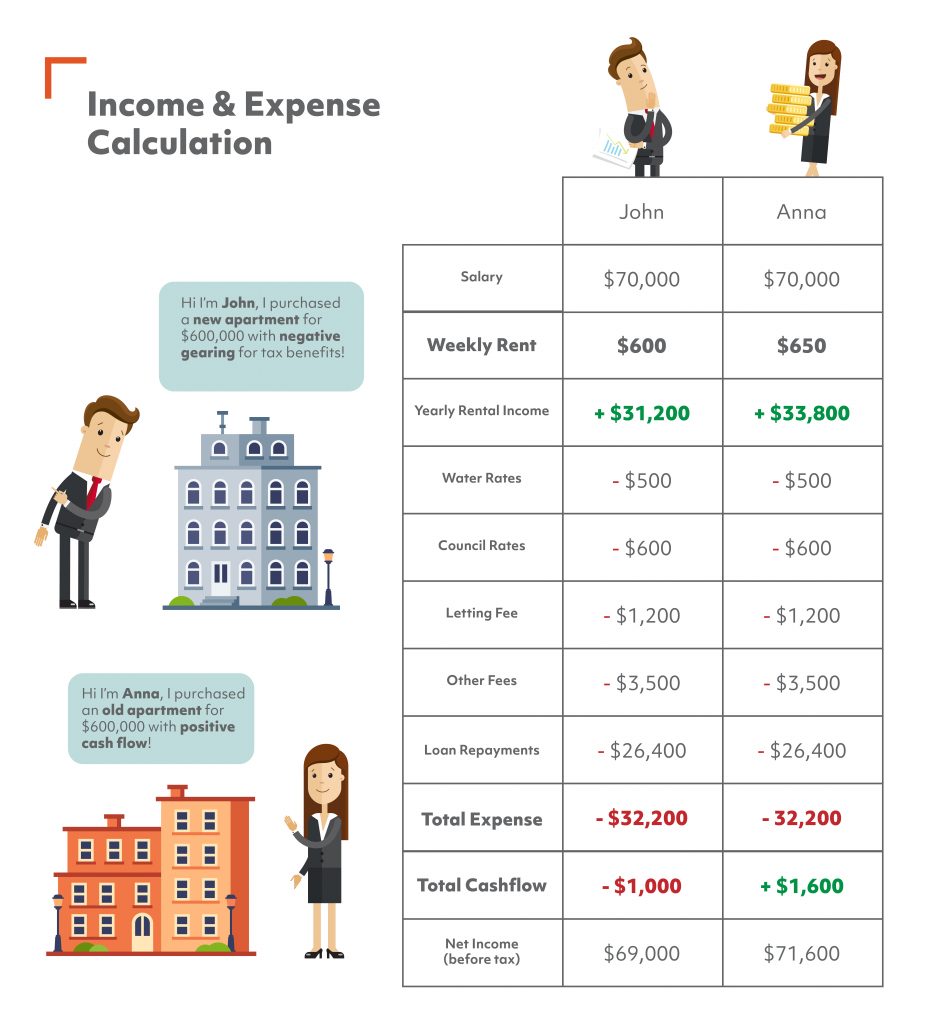

Last year, John bought an investment property – a new apartment – for $600,000 earning a rental income of $600/week. He paid a 20% deposit of $120,000 and has an interest only loan of 5.5%.

At the same time, Anna bought an investment property – a second-hand apartment – for $600,000 earning a rental income of $650/week. She also paid a 20% deposit of $120,000 at the same interest rate of 5.5%.

Annual Cash Flow

As shown in the example above, John’s investment property earning $600/week from rent is negatively geared, meaning his investment requires an additional $1,000 to hold each year. On the contrary, Anna’s property is positively geared with an increased rent of $650/week compared to John, providing her with a positive cash flow of $1,600.

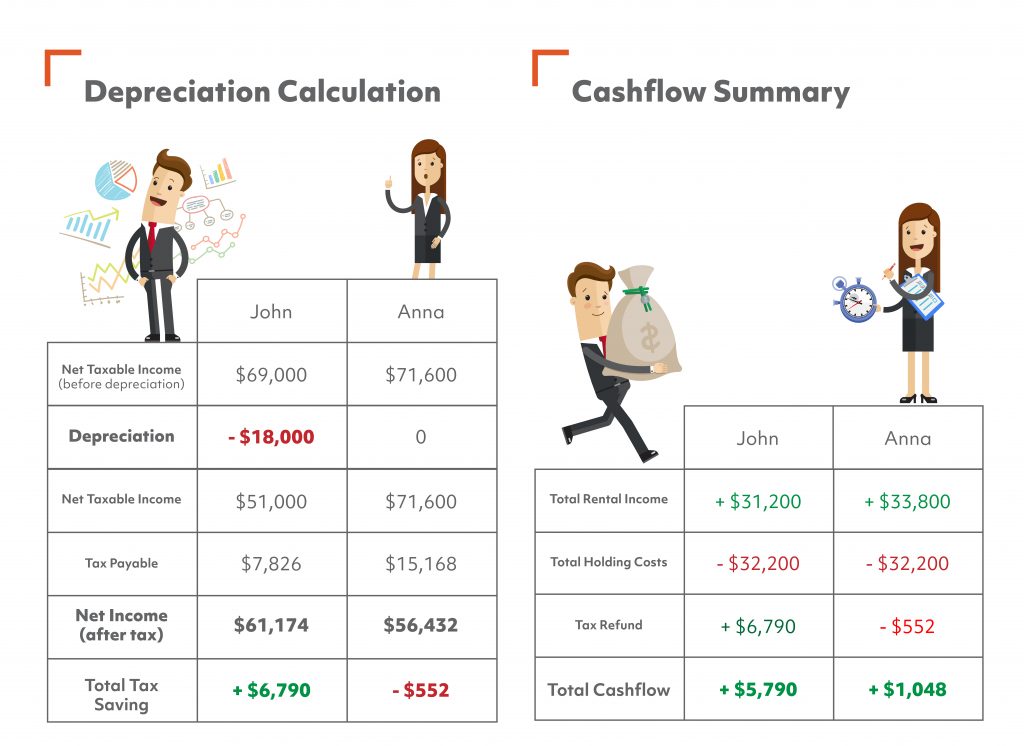

If we add depreciation deductions into the mix, John’s situation changes. With John’s new $600,000 apartment, the property depreciation amount for the first year is $18,000. This “loss” from depreciation plus the $1,000 in negative cash flow equates to $19,000 that can be deducted from his taxable income.

Depreciation Tax Deductions

Compared to Anna who has to pay additional tax as a result of her positive gearing, John’s negative gearing and tax depreciation brings his taxable income down from $70,000 (-$19,000) to $51,000. As a result, John’s tax payable for the year reduces from $14,616 to $7,826, saving $6,790.

This essentially puts John ahead by $5,790 for the year in positive cash flow despite his investment being negatively geared. Even when compared to Anna’s positively geared investment, John is earning $4,742 more than Anna’s investment which does not take advantage of depreciation.

Whilst this is a very simplistic example, it illustrates the importance of considering your options carefully prior to buying an investment property or building a long-term investment strategy.

Our property investment strategists can help tailor a strategy to suit your goals and situation and introduce you to other finance professionals who could help you minimise your tax in the short term whilst building quality assets to your name over the long-term. Book a free appointment via the button below to get started.

This article is intended to provide general information only, current at the time of first publication. It does not constitute any financial advice, offer, contract or inducement to buy. Investors are expressly recommended to do their own due diligence in relation to any investment decision they make and seek independent financial advice.

Start Your Journey

Take the first step towards better results. Book your expert consultation today!