Data shows the housing market recovery is in full swing

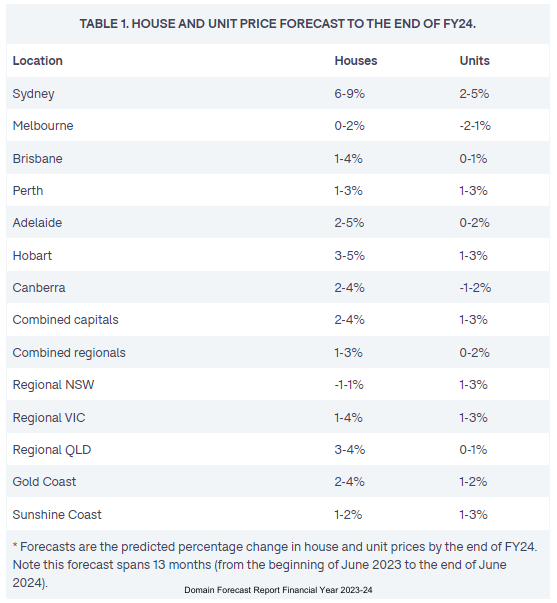

For property investors, the latest Domain Forecast Report makes for some good reading. According to the report, the property market in Australia is now in a strong recovery phase, with house prices in several cities expected to hit record highs over the next financial year. Of these, Sydney comes out on top with projected price growth of up to 9%. What’s more, the report also suggests that unit prices in Brisbane, Adelaide, and Hobart could potentially surpass existing records too.

In this blog, we’ll explore what this could mean for property investors looking to get into the market for the first time in 2023, or those who want to add to their existing portfolio.