Australians paying mortgage faster

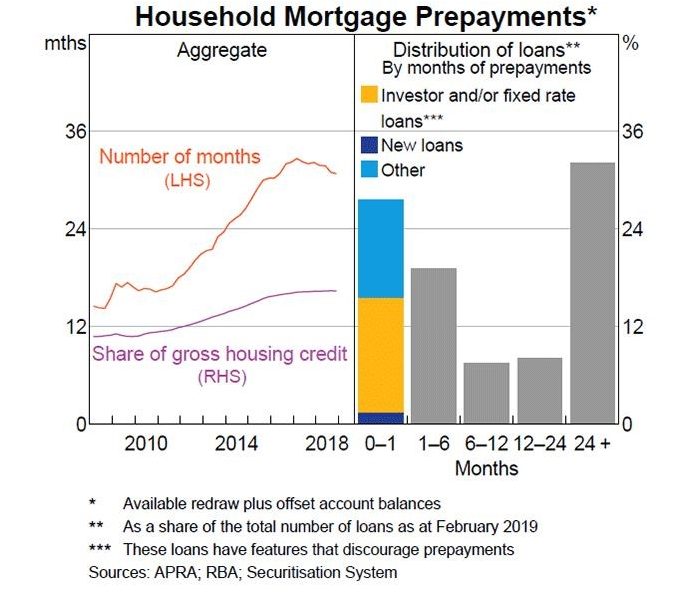

According to research by the Reserve Bank of Australia (RBA), approximately 30% of home loans are two or more years ahead of their scheduled repayment date.

The vast majority of remaining loans are estimated to be at least one month to 24 months ahead.

On the other hand, the percentage of mortgages that are ‘impaired loans’ – ie when a borrower is 90 days behind payments and their loan is in negative equity is only a ‘very low 0.2%.’

This positive financial behaviour has been consistent over the last several years, with banks and brokers largely reporting the same.

Resilient housing market

The RBA’s research reveals that the housing market in our capital cities is more sound than people think. Despite the market pullback in Sydney and Melbourne, the RBA points out that loan to value ratios (LVRs) are strong, with strong positive equity for capital cities. Most of the risk appears to be concentrated in mining towns where a higher percentage of home owners have negative equity.

“The continuing low rates of negative equity outside the mining exposed regions reflect three main factors: the previous substantial increases in housing prices; the low share of housing loans written at high LVRs; and the fact that many households are ahead on their loans, having accumulated extra principal payments,” the RBA report states.

Pay your mortgage off faster

So how are 30% of borrowers managing to get ahead on their mortgage repayments?

Firstly, Australia’s record low interest rates are resulting in lower overall interest payments, impacting affordability.

Better affordability means more Australians are able to pay additional amounts on top of their minimum mortgage repayments. For example, many Australians secured a mortgage years ago when interest rates were 7%+. By maintaining their repayments at the same monthly amount whilst interest costs reduced as the cash rate dropped, the amount of debt they paid off increased. Over the course of many years this adds up to a considerable reduction in debt, meaning many households are now well ahead of their repayment schedule.

A further section of borrowers are saving money in their offset account.

If you’re looking to get ahead of your own mortgage repayments, here are some additional tips to consider.

-

Refinance

Interest rates are at record lows, and banks are vying for the business of people with strong financial profiles. If it’s been a while since you looked into your mortgage, it’s worth shopping around for a lower rate and a good mortgage broker.

-

Structure

A carefully structured loan can help you to increase the tax effectiveness of your loans, increase your interest savings, target specific timelines for paying off your debt and perhaps most importantly, provide you with the flexibility of offset or draw-down facilities. It’s tempting to seek out the lowest interest rate, however a loan with a seemingly higher interest rate and better structure could outperform a loan with a lower rate.

-

Pay more – and more frequently

If interest rates go down, and your minimum payment goes down you could still keep your payments steady. Another example is instead of paying monthly repayments, pay fortnightly. Interest is calculated daily so paying more frequently can reduce the amount of interest paid. If you’re on a P&I (Principal and Interest loan) most of your interest is paid in the early years, so paying higher amounts early on can help you start paying off the principal.

-

Budgeting hacks

Some people swear by small financial / budgeting hacks that make a difference to their mortgage balance at the end of the year. For example, when switching from monthly to fortnightly payments, some people make half their monthly payment each fortnight. This takes advantage of the fact that there are 26 fortnights in a year but only 12 months. Effectively, this means that by the end of the year you’ve made two extra ‘half-payments’ on your mortgage – that’s one whole month extra!

If you would like further information or tips about investing in today’s market, book a free appointment with one of our strategists. You can also subscribe to our monthly newsletter to stay up to date on what’s happening in the market.