Melbourne is still celebrating after emerging from its collective 262 days of lockdown. The state has endured six lockdowns so far during the pandemic, the most extensive seen across the nation and globe. But despite the state enforcing far-reaching restrictions, including limiting live auctions and in-person viewings, this has done little to slow the growth of the residential housing market.

Melbourne enjoyed robust growth across the regions before the most recent spate of lockdowns, with Melbourne’s house prices up 19.5%, rising by over $130,000 in just 12 months. Unit prices continued to soar, with the median price now sitting at $621,898, up 9.2% year-on-year.

According to the latest CoreLogic data, the median house price of the world’s most locked-down city increased by 3.6% to an eye watering $972,659 in the three months to October. All this, despite the real estate market primarily closed for 90 days in the third quarter of 2021.

Now that the state is open and in-person viewings and auctions are back in action, Melbourne’s sales activity is heating up.

Start Your Journey

Take the first step towards better results. Book your expert consultation today!

Current state of the market

According to CoreLogic, Melbourne’s new listing volume is 151.9% higher than the same period last year, but the increase of total listings is only 25.2%. It shows that the market is absorbing the stock rapidly across the city and regions.

This strong demand occurring alongside persistently low advertised supply levels is only adding fuel to the flames.

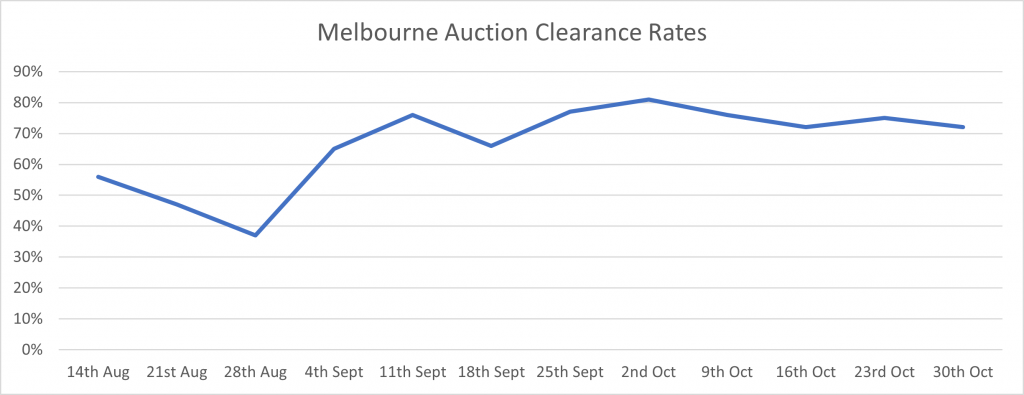

This is clearly reflected in the auction clearance rates across Melbourne, which after dropping below 40% during lockdowns, is now back consistently within the 70%-80% range, indicating the market is performing incredibly well.

Although the median days to sell a Melbourne property is 32 days this September, up from 23 days in the last year, this is expected to shift now that the market is open again, and purchasers can more easily inspect properties, and move forward with confidence. Also of importance, the vacancy rate has dropped from the peak of 4.7% (Dec 2020) to 3.5% in September 2021. With migration set to return in 2022, this vacancy rate is expected to return to pre-COVID levels swiftly, which will attract more investors into the market from across the country and internationally too.

Ironfish Head of Property, William Mitchell, says, ‘It’s remarkable that the Melbourne market has performed so resiliently, even with severe restrictions on inspections and sales activity.

“We expect to see pent-up demand continuing to drive growth in the market over the short term, however purchasers will need to become increasingly selective, as the threat of rising interest rates and further potential macro-prudential changes will impact growth in some areas more so than others.”

When to jump in

It is predicted that the market will continue to rise as the year comes to a close. Now that Melbourne is out of lockdown, many anticipate the market will play catch-up in 2022 to the growth witnessed in Sydney, and hence now represents an excellent opportunity to get in prior to the anticipated growth ahead.

After the RBA announcement in early November that interest rates will remain low for now, for savvy investors, getting a foot on the ladder sooner rather than later and locking in today’s near record low interest rates is expected to be a wise move.

Book your free consultation today for more information on investing within Melbourne and surrounding areas.

Start Your Journey

Take the first step towards better results. Book your expert consultation today!