International Women’s Day: how are you looking after your financial future?

It’s International Women’s Day – a day to celebrate the many achievements of women all around the world and also a chance to look at new opportunities and improvements for the future. So we thought we’d take this opportunity to provide an overview of why we are so passionate about helping people to achieve financial independence, with a focus on why this is so particularly important for women.

Do you have enough to retire on?

Did you know women retire with 42% less super than men? Women often spend time out of the workforce raising children or caring for elderly parents, and then return to work part time or on a casual basis – all of which affects their super and long term financial wellbeing.

Workforce Participation Gap

| Working age (20 – 74 year olds) | Men | Women |

| In the workforce | 78% | 66% |

| Working part time | 15.3% | 43.9% |

Source: “Enabling Change: A fresh perspective on women’s financial security” – Commonwealth Bank Australia.

While women’s super-balances at retirement are improving, there is still about a $120,000 gap between men and women, according to research by the Association of Superannuation Funds of Australia (ASFA).

Late last year, ASFA found that women who retired in 2016 had an average super balance of $157,000 while men had $271,000.

ASFA CEO Dr Martin Fahy said “While women can look forward to retiring with more superannuation than their mothers and grandmothers, the ongoing issue of broken employment patterns and a troubling persistent gender pay gap means we cannot afford to be complacent.”

The gender pay gap

It’s no secret that women earn less than men on average; this ‘gender pay gap’ is influenced by a number of factors, including the reduced working hours or spending time out of the workforce in carer roles that women tend to take on more than men.

The latest stats from the ABS show that the full time average weekly ordinary earnings for women are in fact 15.3% less than for men.

The Workplace Gender Equality Agency (WGEA) – an Australian Government statutory agency – compiles its own research based on data they collect annually from private sector organisations with 100 or more employees, covering about 4 million employees in Australia.

The gender pay gap as calculated by WGEA is even higher – at 22.4% – meaning men working full time earn about $27,000 more per year than women working full time.

ABS and WGEA data both show a gender pay gap favouring full-time working men over full-time working women in every industry and occupational category in Australia.

A man is not a plan

Although women are much more likely to be in charge of the day to day finances of running a household and are often the ‘Family CFO’, studies have shown that women are much less likely to be making major financial decisions.

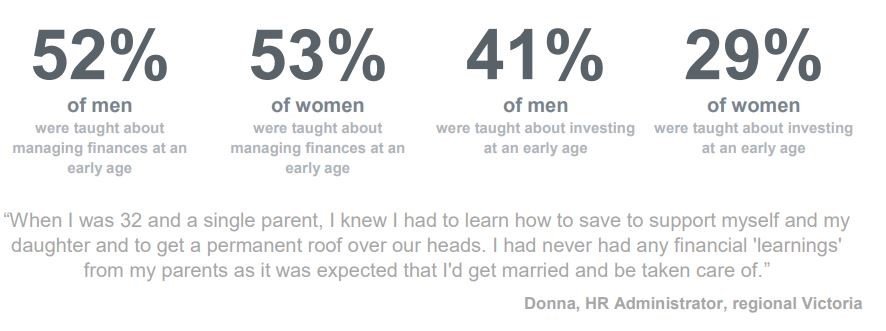

According to research by Westpac, in coupled-up homes, men are the most likely to have all or most of the responsibility for the decisions regarding investments or wealth. Only 31% of women make those long term financial decisions for their household. CBA conducted a similar study on financial security in May last year with similar results, with additional findings that showed that men were much more likely than women to have been taught about investing for their future at an early age.

Source: “Enabling Change: A fresh perspective on women’s financial security” – Commonwealth Bank Australia.

Source: “Enabling Change: A fresh perspective on women’s financial security” – Commonwealth Bank Australia.

Women improving financial wellbeing through property

There are, however, a number of Australian women who are taking ownership of their financial futures, and making up for what they lack in superannuation, by investing in property.

In fact, an analysis of Australian Taxation Office figures late last year has revealed women are proving more adept at investing in property over the long term. Women are also earning better interest on their investments by 0.4% and have been outperforming men for the last decade. Nearly half (47%) of Australians who now own investment property are women.

“This might be surprising to many, but it shows that women know that they start off behind the eight ball when it comes to securing their futures,” said Property Council of Australia CEO, Ken Morrison.

“The outcome suggests women are making deliberate decisions to build wealth in addition to superannuation. Housing allows women to rely on the benefits of asset growth even when they might be out of the workforce.”

According to the 2017 Westpac Home Ownership Report, the number of female property investors is still growing, with more women using property investment as pathway to building wealth for the future.

Kathleen Tan, building wealth through property. Image courtesy: Westpac

Kathleen Tan is one of these investors. The 30 year old not-for-profit worker bought an apartment six years ago in Sydney’s Western suburbs which she rents out.

“For me, I work in a sector where salaries are probably lower than your average, so it was an alternative way of investing to support my future,” Ms Tan told Westpac.

She now plans to sell her unit to buy a home in Sydney’s Northern Beaches in which she’ll live – a move she sees as “another proactive step” in setting herself up financially.

“There’s no way I’d have been able to take this step to buy a home to live in, had it not been for my initial property investment.”

Celebrating our women in property

At Ironfish, we’ve helped many women over the last 11 years to invest in property as part of our commitment to financial wellbeing – from business owners, single-mums, working professionals to Mum/family CFOs.

Meet some of our inspiring customers.

We are also very proud of our culture of women in leadership – from our directors, board members, managing directors, strategists, senior management and wider staff – we have so many strong female mentors and advocates of proactively working towards financial independence.

“While it’s easy to be disengaged with something that seems so far away as retirement, thinking ahead and making small efforts over time could make the world of difference for your financial future,” said Ironfish Perth Managing Director, Helen Qin.

“Women can often hold the key to a family’s financial future as well. We hope to inspire all the Family CFOs out there to take a leadership role, not only in terms of everyday finances but also in terms of longer-term financial decisions for your family, and help lead your family to a happier, more secure future.”