Property Trends Set to Define 2024

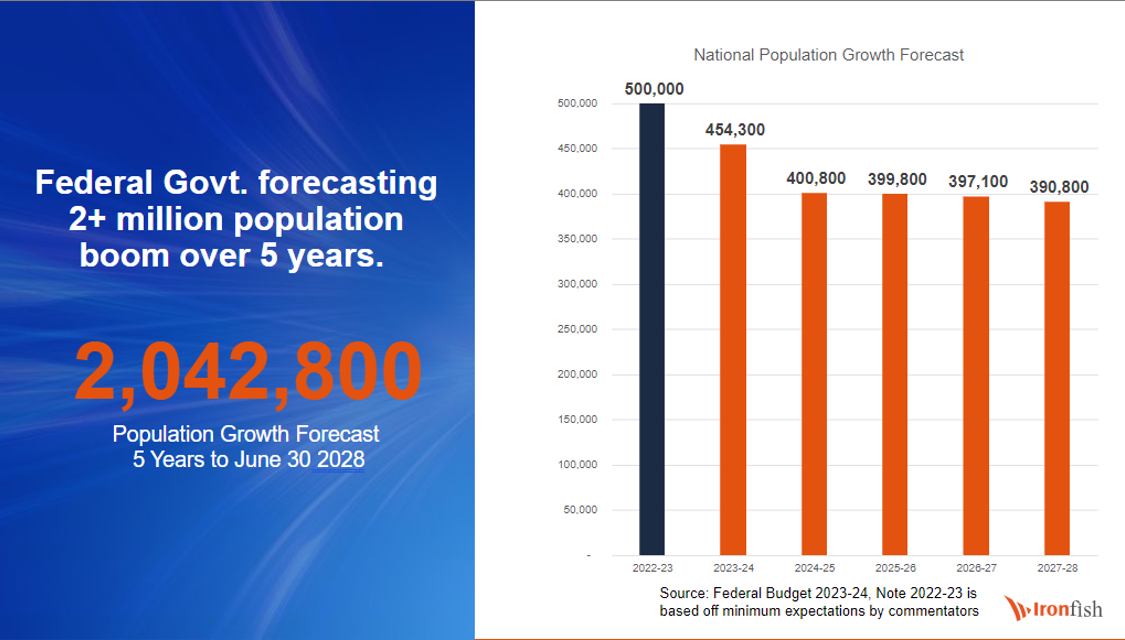

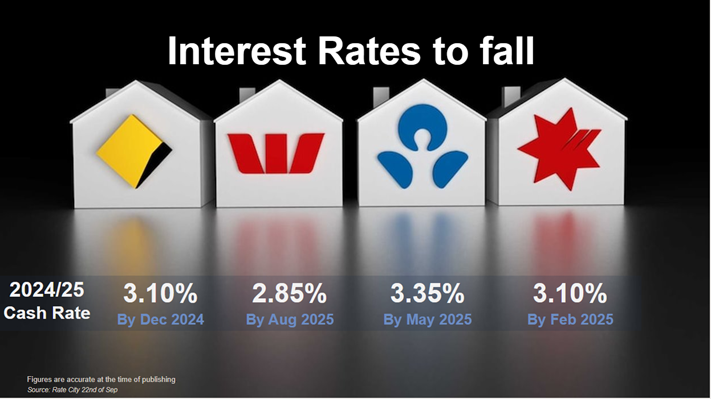

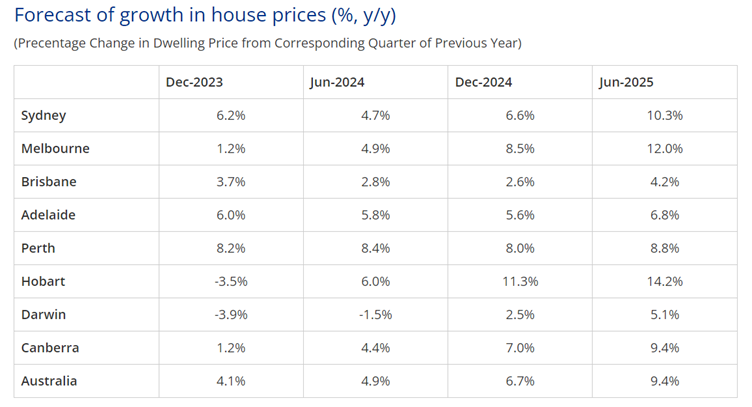

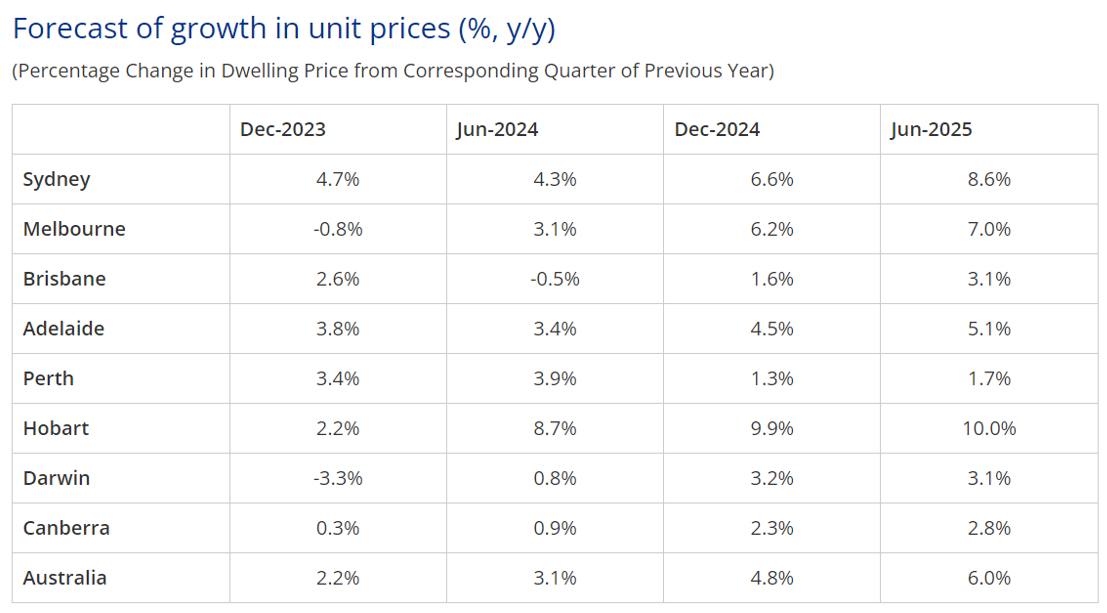

As we look ahead to 2024, the Australian property market is set to undergo significant changes that will redefine the landscape for property investors. The decade-long rental boom shows no signs of slowing down, leading to both increased demand for rental properties as well as rising rental prices.

Surging demand will soon outpace current housing supply pipelines with capital cities at the forefront of this demand. This supply imbalance is a huge opportunity for investors looking to capitalise on the way 2024 is shaping up to be a key year in the Australian property market.