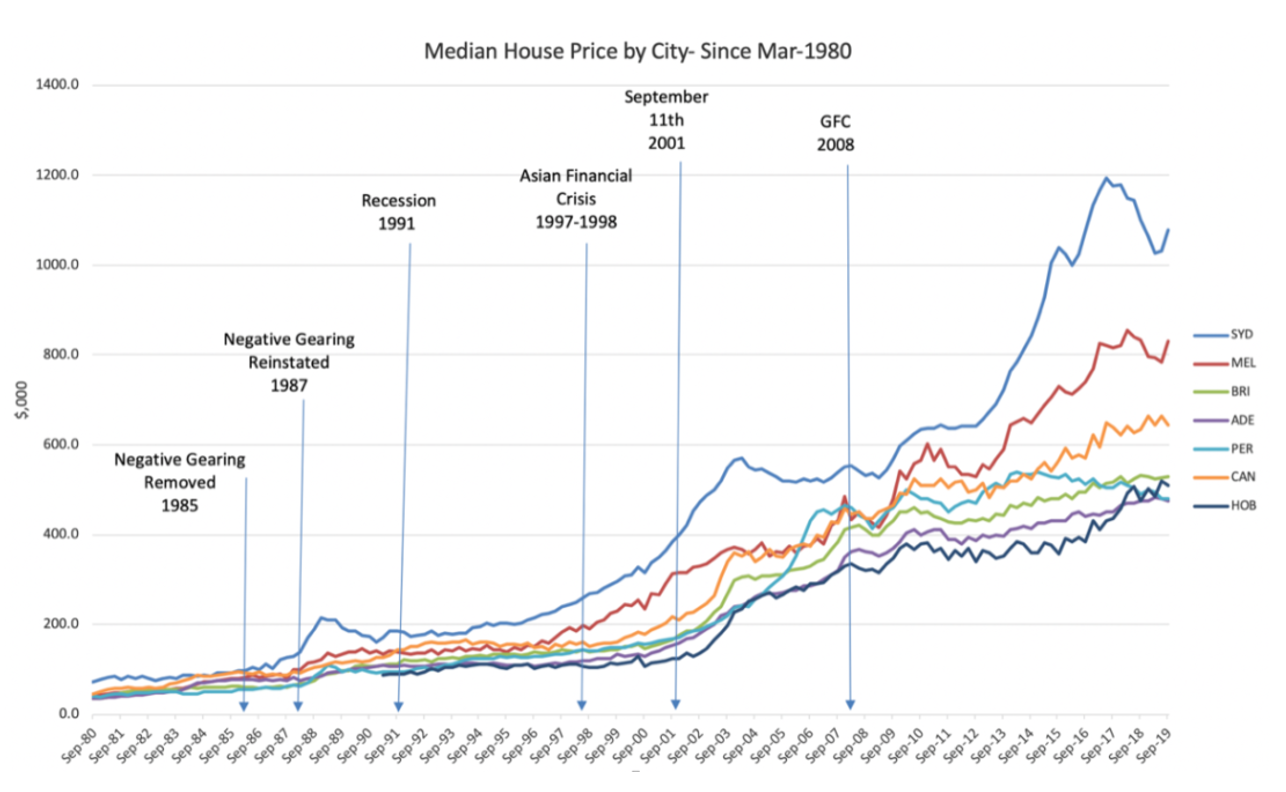

Rentvesting is a perfect start to get into the property market

Buying a home is one of the biggest financial decisions that a person can make in their lifetime. It is also a milestone that many aspire to achieve – owning your own home gives you stability and security for the future.

When you purchase your first home, it’s essential to recognise that you’re also making your first step into property investment and the opportunity to build a portfolio. It is crucial to approach the home-buying process with an investor’s mindset. So, how do I do this?