Sydney property: should I buy now or should I wait?

While average home values across Australia continued to rise in September, in the country’s largest city, prices fell by 0.13%. This is the first time Sydney has seen negative growth since late 2015.

According to the latest data from CoreLogic, this result brings Sydney’s annual year on year growth figure down to 10.54%, compared to 13% in August.

“The flat result provides further evidence that the market is losing steam, and has likely moved through the peak phase of its growth cycle,” said CoreLogic Director, Tim Lawless.

Many property buyers are now questioning – should I buy now, or should I wait to 2018 or beyond? Within the changing market, buyers need to examine some key data in order to help shape their decision.

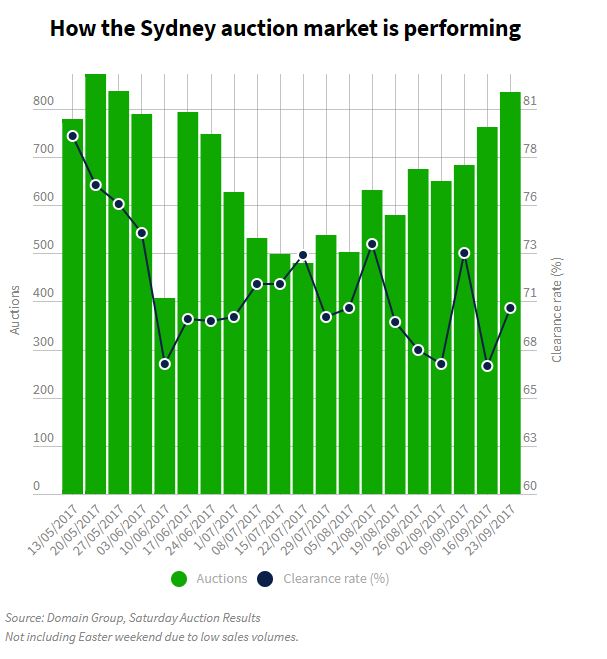

Auction no longer a guaranteed sale in Sydney

Last Saturday, Sydney reported an auction clearance rate of 65.3%, a figure which was significantly lower than the 76.6% reported over the same October long weekend last year.

“Clearance rates are holding at the mid-high 60% range and homes are now taking an average of 41 days to sell, which is on level with a year ago, but substantially higher compared with earlier months of 2017,” said Mr Lawless.

According to Ironfish National Apartments Manager, William Mitchell, “this is a clear indication that steam is coming out of the market and sellers need to be more realistic with their expectations.

“Smart vendors are realising going to auction doesn’t guarantee a result in the Sydney market anymore. We are seeing more sales being completed as ‘sold prior to auction.’”

More choice for Sydney property buyers

The number of total sales listings in Sydney now sits at 23,357, a 16.2% increase over a year ago, giving buyers a lot more choice. Mr Lawless says this increase implies that buyers are slowly getting some leverage back in what’s been a very hot market.

And while all indications tend to point to a slowing market, according to Mr Mitchell, it’s important to understand that the right properties and areas will continue to be in strong demand.

Take for example, 7 Bathurst St in Woollahra, which despite needing total renovation, sold at auction recently amongst ‘spirited bidding’ which pushed it from an initial bid of $1.575 million to $2.025 million.

Selling agent James Keenan said the home’s location, and being short walk to Bondi Junction, in addition to being a freestanding home meant that it held great appeal to buyers.

“While the market may be slowing, the Sydney market is still under-supplied and quality properties will still be in high demand,” said Mr Mitchell.

“What we anticipate happening in times like these is that we will see the emergence of two markets: ‘A-grade’ real estate and locations that will continue to sell well, and ‘B-grade’ property that will likely sit on the market for longer periods, and sellers may have to be more realistic with their expectations.

“Furthermore, rents will strengthen as we see home buyers turn to the rental market as they are either priced out of the buying market or are too concerned that now is not the right time to buy.

“At the end of the day, there’s still opportunities out there, but now you need to do even more research and target markets that are not yet at their peak, and that’s our focus.”