The Key to Building Intergenerational Wealth

Defined as the ability to pass down assets and financial stability from one generation to the next, intergenerational wealth is a goal for many families. It not only provides long-term financial security but also the means to enjoy life on one’s own terms while leaving a lasting legacy for future generations. But building intergenerational wealth is not something that can be achieved overnight, it requires careful planning, commitment, and a team approach.

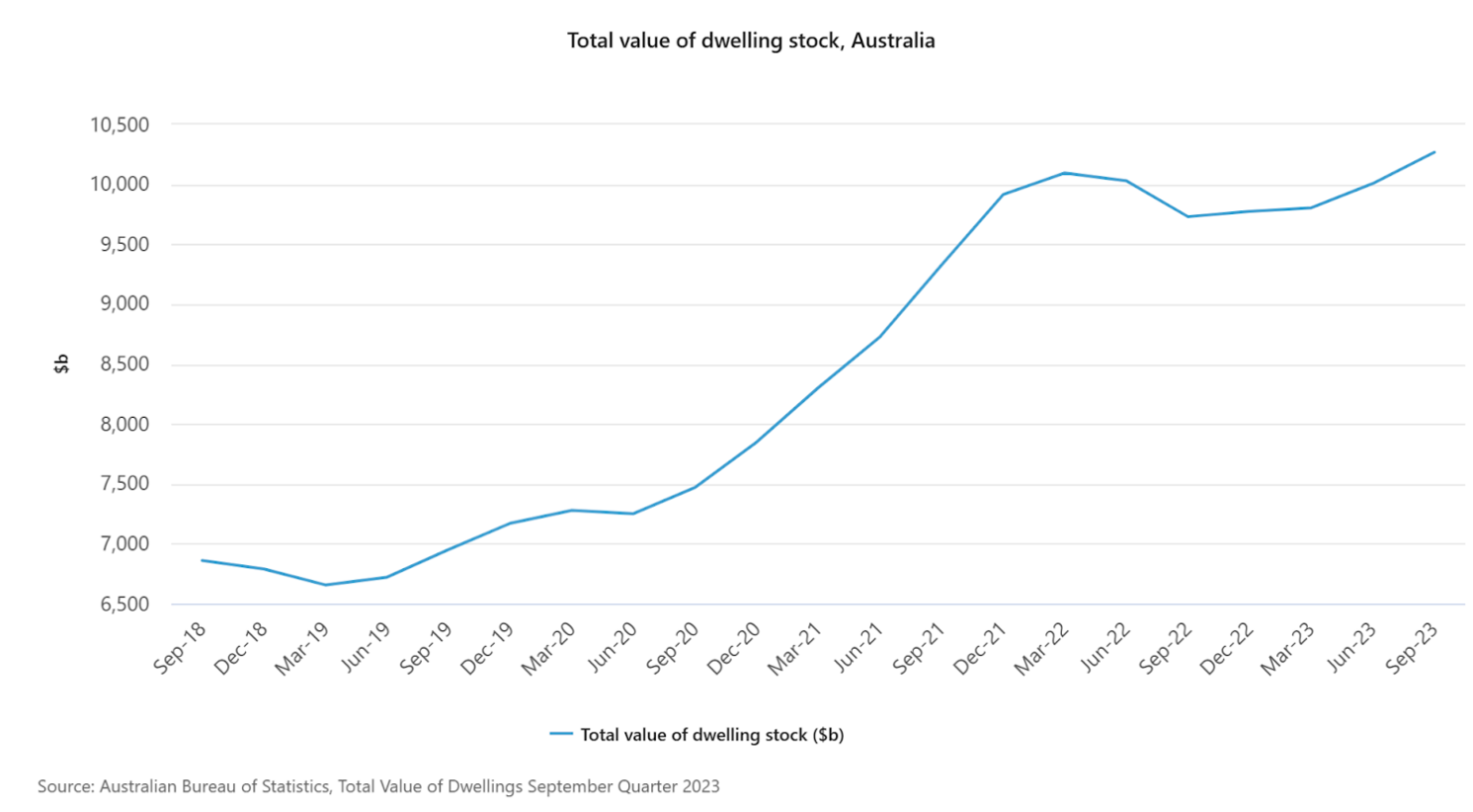

Australia is poised for an unprecedented wealth shift as baby boomers pass down assets to Gen X and Millennials. Projections indicate a transfer of over $3 trillion within two decades, reshaping the nation’s property landscape.

Baby boomers, having enjoyed economic prosperity and property gains, hold substantial wealth, mainly in property and superannuation. This transfer could empower younger generations to enter the market or invest, yet it may also deepen wealth disparities, amplifying divisions between property owners and renters.