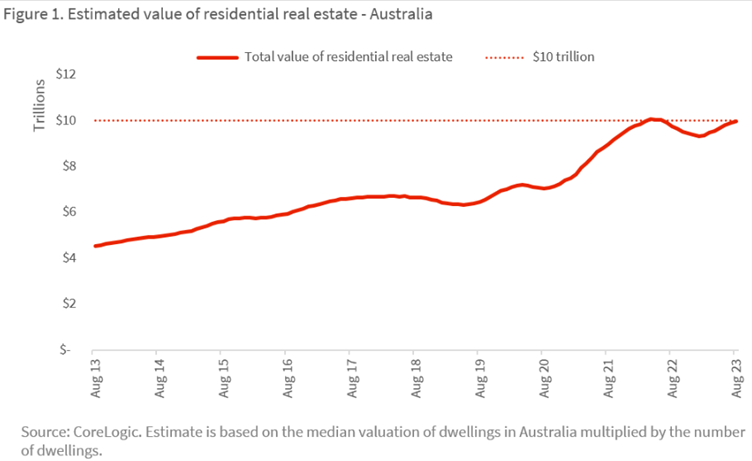

Unlocking the secrets of Australia’s $10 trillion housing market

The Australian housing market continues to be one of the most competitive in the world. With prices continuing to climb, it is important for property investors to have a good understanding of market trends before entering this highly dynamic sector. The growth of the Australian housing market can primarily be attributed to factors such as population growth, low-interest rates, and increased demand for housing in metropolitan areas. The demand is further fuelled by a rise in the number of overseas investors, particularly from Asia. As of 2023, the Australian housing market is valued at AU $10 trillion according to CoreLogic, making it one of the largest globally.