What a pause on Interest Rates could mean for Property Investors

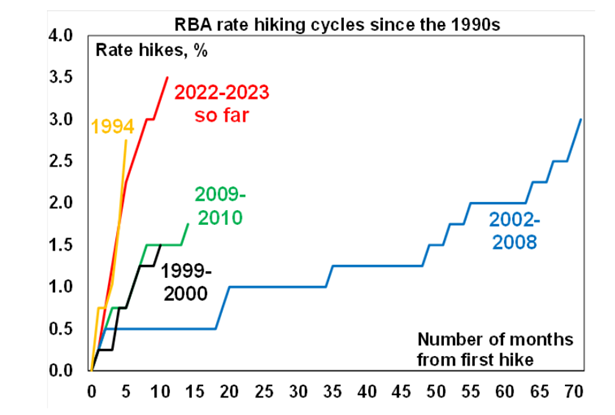

The Reserve Bank of Australia’s recent spate of interest rate hikes might soon be heading for a pause. We have experienced 10 back-to-back interest rate rises over the eleven months since rate hikes started in May last year, culminating in a 3.6% cash rate in March. It has been the steepest rise of rate cycles since the 1990’s and it is the fastest tightening of cash rate since the late 80’s where we saw rises from 10.6% to 18.2% between January 1988 and November 1989.