Why invest in property in Australia?

A message from our CEO & Founder, Joseph Chou

In 1998 I made a decision that would change the course of my life. I went to a property investment seminar, and as a result of what I heard and subsequently learned under the mentorship of an experienced investor, and the help of a dedicated team, I was able to build a portfolio of 7 investment properties within 12 months. Properties, which have long since been positively geared, have appreciated substantially in value and some of which I still hold today.

Since then, I have also invested in many more residential and some commercial properties, as well as making other investments, including listed stocks and tech start-ups.

What I have learned from my personal investment experience – and from about 20 years of working in the property industry – is that it is no accident that so many Australians hold most of their wealth in property.

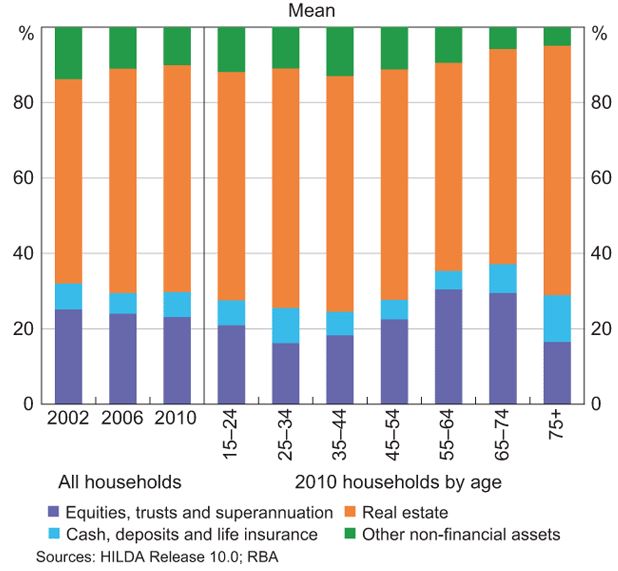

Composition of Assets in Australia

Residential property dominates all forms of investment in Australia. It has a current collective value of $7.5 trillion, more than triple the value of our listed stock market ($1.9 trillion). When you think about this from a global perspective; Australia has only about 8% of the US population, but our residential property is worth nearly a quarter of the US!

Furthermore, residential property in Australia is quite stable – only about 5% is traded each year.

So why do we love residential property so much?

There are many reasons why Australians love residential property. Home ownership remains a strong Aussie dream, even amongst younger people today. It’s also very tangible; it’s an investment that is easy to understand.

For other Australians, residential property investment is part of safeguarding their retirement; to ensure they can be financially free to enjoy the last 30-40 years of their lives.

At Ironfish, this is very much part of our mission, because we know how important a project this is in your life. The average superannuation balance of Australian men and women at retirement age is $157,050 for women and $270,710 for men[1]. The age pension in its current form will pay a maximum of about $25,000 per year for a single person, and $37,000 per year for a couple.[2]

Yet, ASFA, Australia’s peak superannuation body, tells us that the cost of a comfortable retirement is roughly $43,000 per year for a single person, or $61,000 a year for a couple.

Either way, the shortfall is obvious.

Building wealth for your future

Building wealth to safeguard your future is a worthy and necessary goal. But it’s important to note that buying an investment property is not the same as building long-term wealth through property investment. Understanding the power of leverage, having an effective investment strategy and the right team support along the way is essential.

If you’re considering property investment or building wealth for your future through property investment, here are some key points you need to know.

-

Track record

I read in the paper about a small 2-bedroom unit in Mosman that was purchased in 1964 for £8,754 (about $17,500 equivalency). Fifty years later, in 2014, slightly before the height of Sydney’s last peak, over 100 buyers turned up to the auction, and it sold for $1.46 million – which was $210,000 above the reserve. The property had been largely unrenovated in 50 years, but the combination of time and its great location led to a result 83 times higher than the original purchase price.

5/3 The Esplanade Mosman was held for over 50 years and sold for $1.46 million. Image source: Daily Telegraph

While there will always be market fluctuations, the Australian residential property market has a 100-year track record of growth. People will always need somewhere to live – and while we don’t know how government policy or other factors may change into the future, we do know that our current population growth, particularly in our big cities is about 30 years ahead of schedule. And though Australia is a huge land mass, the majority of people live in our capital cities where there is a limited supply of land and which will therefore limit the supply of housing.

-

Accessibility

Much like banks may be more likely to lend you money for a business franchise, with an established brand, business model and track record – banks are prepared to lend you up to 80% of the value of a property. This signifies a lot of confidence from lenders around this asset class. And while there is now a greater and necessary emphasis on prudent lending practice and serviceability, it’s worth remembering that we’re still talking about the ability to borrow up to 80% of the purchase price – making it a very accessible investment option for many Australians.

-

The real return

The power of leveraging finance from the bank to build a property portfolio is something people often don’t understand. When capital growth is calculated it’s based on the property price. But as an investor, you only put in 20% of the purchase price. So, for a $500,000 property, which may have doubled in value to $1,000,000 after 10-15 years, you only put in $100,000 as a deposit plus costs, which means the return on your initial investment has actually been x10.

When I first started investing back in 1998, I bought two 1-bedroom apartments near Central Station in Sydney for $195,000 each. I was more aggressive back then as a new investor, so I borrowed 90% – 10 times the leverage. Today, the market value of these apartments is around $700,000 – $750,000 each. They bring in about $500 – $600 a week in rental income. All of this compared to my initial investment of $19,500 is a testament to the power of leverage!

-

Leveraging time & knowledge

When I talk about the power of leverage, it is not simply in terms of leveraging finance from the bank, it’s also the ability to leverage other people’s time and expertise. Many investors spend countless weekends viewing properties only to end up failing to act, wasting a lot of time and effort. On the other hand, Ironfish customers, for example, can leverage their strategist’s knowledge and experience; the research of our property and research team; the local knowledge of our national branch network; the support of our customer care team and our group buying power in pre-negotiated pricing.

-

Help from your tenants and the ATO

I have a personal theory about property investment: it’s almost like going into business with the bank. They will put in 80% of the cost but won’t ask you for any shareholding in your ‘business’. You need to pay them interest, but any growth and any rental income you receive is yours to keep.

Meanwhile, your tenants are paying much or even all of the mortgage. We have a growing population of renters in Australia who will provide rental income and keep the banks happy. This rental income will also become a form of passive income for you.

The tax office helps as well, a unique legislation advantage here in Australia. You also don’t pay capital gains tax until you sell a property, and you don’t need to sell a property to realise the gains – you can simply refinance and use your equity to build your portfolio further.

-

Commercial or residential?

For commercial property, the value tends to be pegged against the rental yield, which is not necessarily the case for residential property. Commercial property is also more likely to have longer periods of vacancy, which will make it harder to hold long-term. I started investing in commercial properties, only after I’d built a substantial portfolio of residential property – I believe that residential property should be the foundation of your portfolio.

-

Think long-term

Warren Buffet famously said: “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

The same can be said for property investment. If you’re not willing to hold property for at least 10 years, don’t bother. Property is a long game and at Ironfish we recommend our Portfolio Approach, and buy and hold strategy.

Time in the market is ultimately important, but it also makes sense to invest in line with property cycles. Many people buy when everyone else is buying – which is too late to take full advantage of that particular market cycle (though not necessarily the next cycle). Others lose faith during market fluctuations and sell too early.

The truth is, the challenges with property investment are entirely in your hands: it’s either a cash flow issue or a loss of faith. Ensuring you have the capability to hold the property as long as it takes to achieve the capital growth you’re targeting is down to you. Keeping the faith is also up to you.

What’s interesting is that of all the many thousands of customers we’ve helped over the years, loss of faith is much more likely to make investors give up on property rather than a cash flow issue. There are some investors who have experienced major life changes which required them to sell their property. But more often, it’s because they’ve lost faith along the way and have decided to give up.

Who is on your team?

This loss of faith is understandable when you consider that property investment is a long journey. That’s why it’s so important to have a good mentor and a supportive investment team – consisting of your strategist along with the right accountant, solicitor and broker or bank manager. Your team will be working hard to keep you on track to ensure you achieve your long-term goals.

Think about a highly successful athlete. Roger Federer, for example, doesn’t become a champion on his own, he travels with an ‘entourage’. They’re not there to look good; they have been carefully selected with the specific purpose of giving him the best chance of success. He has his tennis coach to help him perfect his technique; his psychologist to give him the mental edge; a physio to support him through injury; a physical trainer to keep his body in top shape and a family member or friend for crucial emotional support. With the right team – a supportive and expert team – success becomes much more achievable, whatever you may pursue in life.

With all my years of experience in property investment, this is the most important tip I can share with any new investor. Don’t buy because everyone else is buying or sell because of a sensationalized media headline. Have a strategy or plan in place; think about why you are investing and what you want to achieve financially, in 15, 20, 30 years’ time. Find yourself a mentor and surround yourself with the right team who can help you develop and execute your plan until you achieve it.

‘Financial freedom’ is a phrase people love to throw about, but few manage to achieve in their life time. If you want to give yourself the best chance of success: be strategic, be persistent – and don’t feel like you need to do it alone.