Since March, the government has been rolling out a suite of packages to support Australians whose employment has been impacted by Covid-19 and support the broader Australian economy.

Start Your Journey

Take the first step towards better results. Book your expert consultation today!

Jobseeker payment

The Jobseeker payment is available for eligible Australians who are looking for work and meet the income test as a result of the economic downturn due to the Coronavirus. The asset test and the one week waiting period has been waived.

This payment is tapered, so if you are now earning $0 you will receive the full payment, whereas if you are now earning half your usual income, it will taper down accordingly.

In addition, if you’re eligible for the above Jobseeker payment (or if you already receive other Human services payments such as Youth Allowance Jobseeker, parenting payment or others) then you will also be eligible for the Coronavirus Supplement Payment. This is a new additional support payment of $550 per fortnight starting from 27 April 2020.

Jobkeeper payment

On March 30, the Morrison Government announced it would be offering businesses a wage subsidy to help businesses keep staff employed until Covid-19 related restrictions are lifted. This Government subsidy is called the Jobkeeper payment and will pay $1,500 to businesses per fortnight per employee for up to 6 months so long as they’re eligible.

That payment would need to be passed on to the employee and the roll out would start in the first week of May but businesses could receive back-dated payments from 30 March 2020.

Unemployment forecast dropped

The roll out of the Jobkeeper package has resulted in Westpac economists amending their peak unemployment rate forecast from 17% to 9%.

With a reduced unemployment forecast, Corelogic expects that more Australians will be able to continue their rental payments without experiencing housing affordability stress.

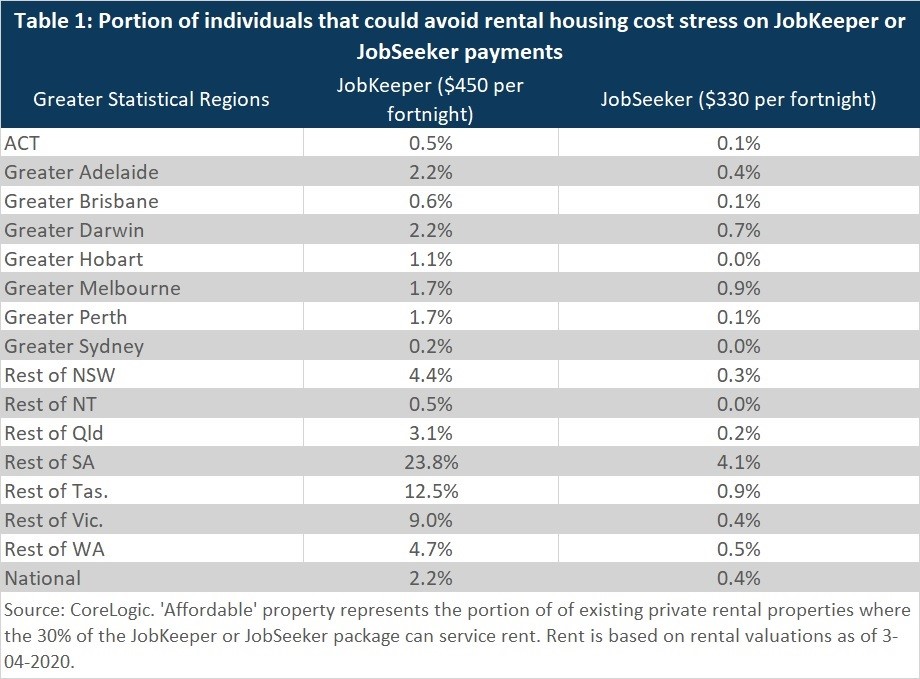

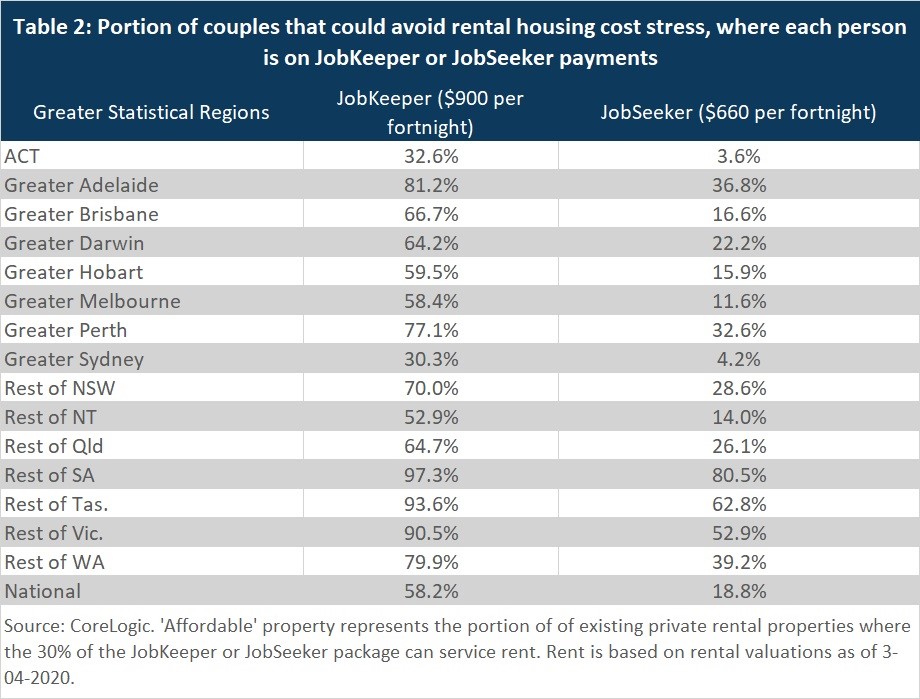

“Housing affordability stress is a situation where households expend more than 30% of income on housing costs, such as rent,” Eliza Owen of Corelogic, explains.

“To understand how many households may be better off, it is worth considering how many rentals are currently able to be serviced on 30% of the JobKeeper payment.”

“The data highlights that the JobKeeper payments significantly increase the portion of affordable private rentals in Australia,” Ms Owen notes.

“Flat payments are proportionately beneficial for renting households where rents are cheaper, such as in Regional Tasmania and South Australia. Incidentally, these are areas that may be more severely impacted by the economic slowdown in terms of the concentration of the labour force in agriculture, food service, tourism and accommodation.

“But even with the relatively small portion of rental properties being affordable elsewhere, it is likely that current social distancing measures would see less discretionary spending, enabling a higher portion of income to be used in servicing rent.”

“All the new measures will go a long way to helping reduce unemployment during this period, ultimately providing greater certainty for investors and tenants alike that rental payments will continue to be affordable,” said Ironfish Head of Property, William Mitchell.

“It is also worth noting that the Jobkeeper payment will not only provide $1,500 per fortnight per employee that has been stood down – it is also applicable for those who are facing a reduction in working hours or a reduction in pay. For example, a business may need to reduce the pay of each of its employees by $2,000 per fortnight for a temporary 6-month period. Given the business is eligible for the $1,500 Jobkeeper subsidy, it now only needs to reduce its employees’ wages by $500 per fortnight, not $2,000. As a result, there will be many employees across the country that are earning more than the $1,500 Jobkeeper subsidy alone, meaning the percentage ranges in the tables above are anticipated to be much stronger in reality as many households will have significant additional income on top of the JobKeeper subsidy.”

Stay up to date on Covid-19 and its impact on your investments – sign up to our updates.

Start Your Journey

Take the first step towards better results. Book your expert consultation today!