Why Brisbane is forecast to grow by 20%

Download our in-depth analysis of the Brisbane property market and what this means for investors here.

There is one question investors always want the answer to: “is now the right time to buy?”

At Ironfish, we know that what’s likely to happen over the next 10 years in the property markets is more important than the past 10 years. Our aim is to position investors in the right markets, at the right time – to take full advantage.

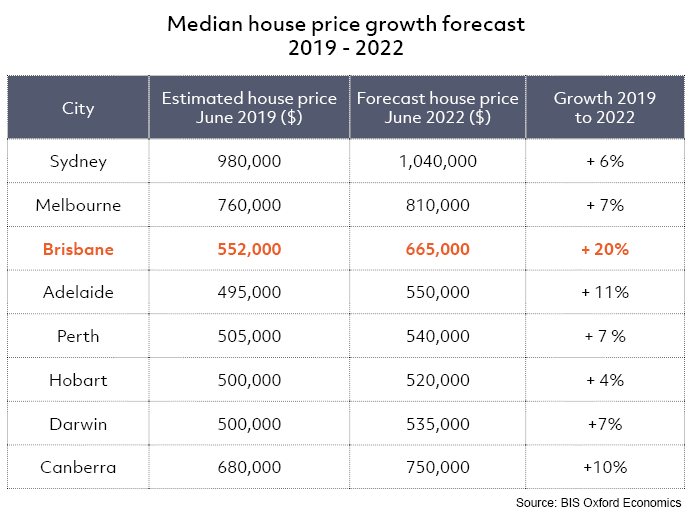

One of the markets looking likely to outperform the national market over the next decade is the growing city of Brisbane. BIS Oxford Economics sees strong potential, having just released its Residential Property Prospects 2019-2022 report. They’ve predicted that Brisbane will be the strongest performing market over the coming years, growing by 20%, with apartments anticipated to perform strongly too at 14%.

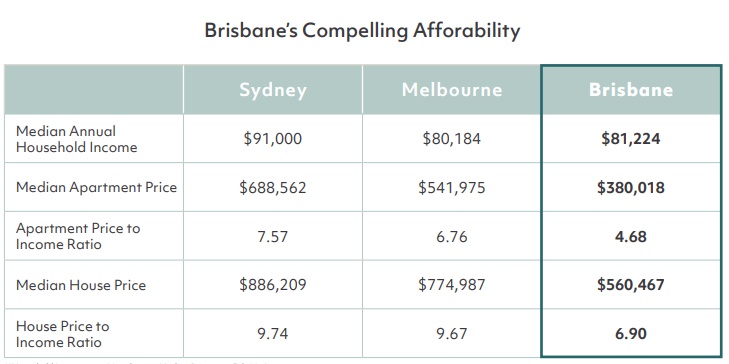

Brisbane is currently one of the most affordable capital cities, suggesting that its residents can comfortably pay more for property compared to their neighbours in Sydney and Melbourne.

*Household income as at 2016 Census, Median Price CoreLogic 2019

So what are the key factors that could influence price growth in the short to medium term – and why are they apparent in the Brisbane market today?

Download your free report on the Brisbane property market here.

Increasing population

Australia’s population has been steadily climbing, and Brisbane is no exception. With the cost of living already high in Sydney and Melbourne, Brisbane is becoming an ever-more attractive option. Delivering on lifestyle as well as affordability, more Australians are moving away from these major cities to QLD’s capital. “Brisbane has the highest interstate migration in 10 years” said Ironfish Head of Property William Mitchell. “People are looking for lifestyle and for employment. Brisbane delivers.”

Growing economy

Brisbane has recently been tipped by Deloitte Access Economics to become the east-coast leader in economic growth over coming years with strong jobs growth in the health care and education sector expected to drive this. According to Deloitte, over FY2019 to FY2022, Melbourne is set to grow by 2.8% p.a., Sydney by 3.1% p.a., and Brisbane by 3.5% p.a..

Major infrastructure pipeline

Brisbane has a crucial infrastructure pipeline scheduled for completion in the next 5 years, expected to create jobs and drive more tourism to the sunny city. Expanding the airport, a new world-class casino and integrated resort, and a larger rail network are all expected to impact the wider Brisbane market. Experienced investors aim to buy ahead of this curve, before property prices are impacted.

“Brisbane has a $15 billion infrastructure pipeline which brings jobs and obviously money flowing through the economy.” Mr Mitchell added. “It’s going to be a key catalyst for growth.”

Slowing property supply

Brisbane locals have seen first-hand the cranes coming down since mid-2017 – a tangible indicator that supply of new properties in the city has dramatically slowed. Coinciding with Brisbane’s strongest rate of interstate migration in 10 years the rental market has tightened, tipping Brisbane into a landlord’s market.

“The supply of new apartments into Brisbane has fallen by more than 50% since 2016, and this isn’t looking likely to turn around any time soon” shared Mr Mitchell. “coupled with Brisbane’s growing economy and population, it paints a clear picture of where this market is heading, and it is certainly one we will monitor closely over the years ahead.”

To read this report in full, click here to download.