APRA to remove interest-only lending restrictions on 1 Jan

The Australian Prudential Regulation Authority (APRA) has announced that it will remove interest-only lending restrictions from 1st January 2019.

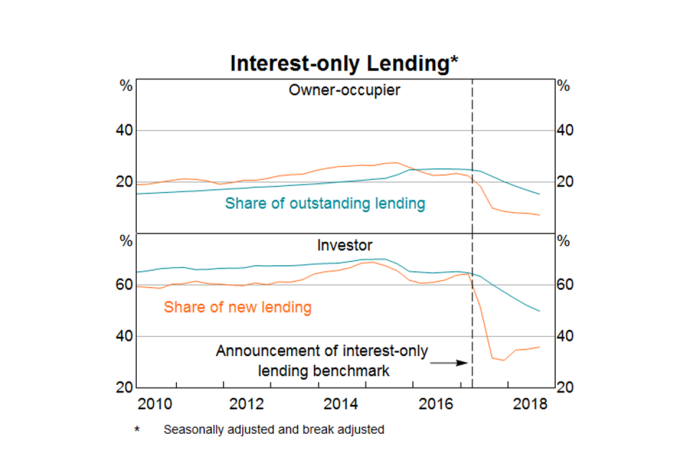

These restrictions were originally introduced in March 2017 and essentially forced lenders to restrict the percentage of their new interest-only loans to 30% of their total home loans that they issue.

The restrictions have been very effective in curbing interest-only lending, as evidenced by the chart below.

Source: RBA, JP Morgan

“This announcement is good news for property investors who can now look forward to some improvements in terms of credit in the new year,” said Ironfish Head of Property William Mitchell.

The announcement comes off the back of cooling markets in Sydney and Melbourne, which previously enjoyed strong growth, placing significant pressure on housing affordability.

“We expect the measure will bring more buyers back into the market, particularly in Sydney and Melbourne, in due course,” Mr Mitchell added.

JP Morgan’s Chief Economist Sally Auld said that while she doesn’t expect a quick acceleration in interest-only lending, she does expect borrowers to potentially benefit from cheaper interest-only loans.

“Interest-only loans were repriced quite significantly [higher] in the wake of this regulation, so there will likely be some reduction in rates for these loans,” Ms Auld told the ABC.

The announcement from APRA marks the second time this year that the regulator has relaxed lending restrictions.

In April, APRA lifted the 10% annual “speed limit” on investor credit growth which had been in place since 2014.

“APRA’s lending benchmarks on investor and interest-only lending were always intended to be temporary,” APRA Chairman Wayne Byres said.

“Both have now served their purpose of moderating higher risk lending and supporting a gradual strengthening of lending standards across the industry over a number of years.”

Want to stay up to date on the latest property market news, investment information and resources? Why not subscribe to our monthly newsletter.