The benefits of buying investment property off the plan

Buying off the plan essentially means buying a property that is yet to be built. You can view the developer’s plans, designs and renders for the property but can not view a physical building.

Say, for example, you wish to buy an apartment as an investment property. You could go to the auction of an existing property and make a bid in the hope that you will be successful. The constantly evolving market may mean that you could be waiting a long time before you find a property in the right area, and place a winning bid.

In contrast, buying off the plan locks in the price of the property, even if the completion date is a year or two in the future.

Here are 5 key advantages of buying an investment property off the plan.

1. Early access to a building or estate

New property launches usually feature a ‘pre-public’ stage followed by a ‘public’ opportunity to purchase. In most cases, this occurs before construction has started. Investors who don’t get in early often miss valuable opportunities. Investors who access VIP pre-public releases enjoy certain significant advantages.

When you have preferential or early access to a development, it means you can choose your preferred floor-plan, aspect or views. Premium properties within a development tend to be snapped up early, and may not be available after an estate or apartment complex is built.

With an off the plan investment, you can get in on the ground floor – or the penthouse, if you prefer.

And after you have paid the deposit you have a clear savings goal to aim for until settlement. Many investors leverage the long settlement period associated with buying off-the-plan as part of their long-term portfolio building strategy.

2. Greater appeal for future tenants

A new property or building which demonstrates contemporary best practice in terms of architectural and environmental design often has great appeal for future tenants.

For example, the latest apartment design has shifted tremendously from buildings of the past. New apartment buildings create lighter, brighter and infinitely more liveable spaces that are so much more appealing and alluring than previous “box” type living offered by apartments of previous decades. New designs also encourage community and offer enhanced lifestyle benefits through resort-style shared facilities or ground-floor retail and dining experiences.

3. Stamp duty and depreciation

Stamp duty can slug investors when buying an existing property. But buying off the plan can allow investors to minimise this cost as there are many Government incentives and stamp duty concessions on offer for people who purchase new. Concessions vary from state to state, so check the local conditions with your property investment strategist.

Buying off the plan means you are eligible to claim depreciation based on a new property. Once your property is completed and quantity surveyed, you can claim annual depreciation on everything from the bathroom taps to the air-conditioning unit.

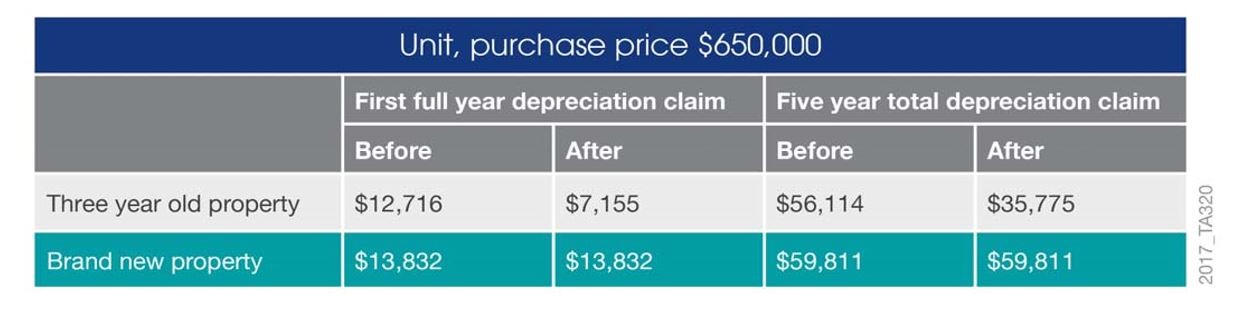

The difference between the depreciation claimable for second-hand versus new properties is substantial; representing potentially thousands of dollars-worth of depreciation entitlements each year, particularly in the first five years.

Depreciation scenario – purchasing before and after 9th May 2017. Source: BMT Tax Depreciation

4. Off the plan property is easy to hold

By buying off the plan, before the property settles, you have the advantage of holding a property without any of the financial or administrative issues associated with it – paying a mortgage, managing tenants, or paying bills.

During the construction period your property may even increase in value, even though you have outlaid only the deposit.

5. Look for the x-factors

An x-factor is infrastructure that adds value to a residential area. It could be a new shopping complex, a hospital or railway line that will put upward pressure on the value of properties in that area.

Delayed settlement with an off the plan purchase means the effects of an x-factor can happen gradually, increasing the value of your property over time. Find out which areas in your city are earmarked for an x-factor development over the next decade or so and consider investing in these areas.

6. Avoid the hassle of renovation

Another distinct advantage of buying investment properties off the plan, means you are buying a ‘turnkey’ property – one which requires no renovation – it’s ready to rent out and move into straight away. Some investors enjoy the idea of renovating a second-hand property, but for many others, they lack either the time, expertise or inclination to go through this process and execute it successfully. Buying off the plan allows investors to avoid any hassles associated with initial renovation and repair-work which second hand property can require.

One final word – location is often the major drawcard for any property you choose to purchase. Finding the right area, and then, the right property within that area is the key to success.

If you would like further information on tax depreciation, stamp duty or other benefits of purchasing new properties, please feel free to book a complimentary appointment with your local Strategist, who will be able to answer any questions you may have.