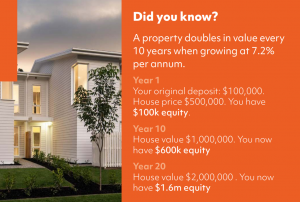

Jump Start your Investment Property Portfolio Journey

2022 was a lot. A lot of negative news in and around the property market. We saw a lot of people, including investors, who intended to reach new financial goals in 2022, but got preoccupied along the way. But with the turning tides, 2023 can be your opportunity to get back on track.